Analyses and opinions on double taxation between Poland and other countries

Do you run a business or work in different countries? Do you live in Poland but you earn your bread abroad? You might be exposed to the risk of double taxation, i.e. paying twice taxes on the same income. Relevant legal regulations and international agreements make it possible to avoid such a situation. Find out how and under what conditions.

Avoid double taxation of your income

We invite you to contact our tax advisors who will analyze your situation and prepare a tax opinion that will help you to avoid double taxation of your income or that of your employees. As part of our services, we will explain which method of avoiding double taxation is applicable in your case, calculate the income tax rates due, complete the relevant tax returns and documents, and help you pay taxes both in Poland and abroad. With us, you have the assurance that double taxation will be avoided in accordance with the provisions of international and domestic law.

If you or your employees fall under one of the categories listed below, you may be affected by the provisions on the avoidance of double taxation:

- Expatriate workers,

- You live in one country and are a management board member of a company in another country,

- You live in one EU country and work in another, so-called cross-border workers,

- Employees working in one country for a company based in another (e.g. IT specialists, IT developers, graphic designers)

- Professional athletes and artists (e.g. musicians, theatre and television actors),

- If you are posted abroad as a civil servant

- Pensioners abroad

- Unemployed persons looking for work abroad

If you need a tax opinion on double taxation agreements, please contact us.

International double taxation treaties

A Polish tax resident who, for example, earns income from employment abroad is generally obliged to pay tax on this income in Poland (unlimited tax liability). At the same time, there is an obligation to tax the income at source, i.e. in the country where it was earned. This leads to double taxation of foreign income - in the country where it is earned and in the country of residence.

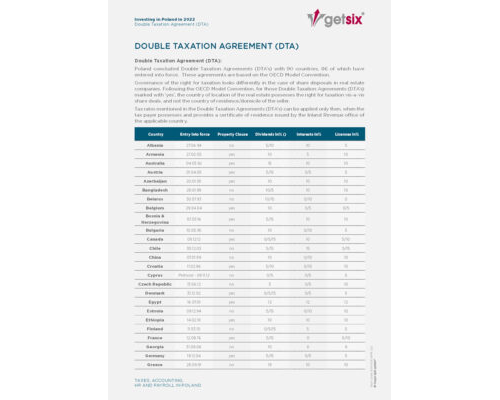

Such situations are prevented by special treaties to avoid double taxation. Poland has signed them with almost one hundred countries (full list on the website of the Ministry of Finance): List of Double Taxation Treaties (SDGs) (podatki.gov.pl)). They determine when and where remuneration received by residents of a country for work performed outside its borders can be taxed in the country where the income is earned and when it can be taxed in the taxpayer's country of residence.

Methods of avoiding double taxation

The obligation of double taxation of income earned abroad can be avoided through:

- the exclusion method with progression, where only income earned in the country of residence is taxed in the country of residence. Income earned abroad is only taxed abroad. However, the amount of income earned abroad influences the tax rate applicable in the country of residence. This method is used, for example, in double taxation agreements concluded by Poland with Germany, France or the Czech Republic.

- the proportional deduction method - this method enables the foreign tax to be credited against the tax paid in the country of residence. This method is used, for example, in Poland's double taxation agreements with the Netherlands, Norway or the United States. This method is also applied if the double taxation treaty between Poland and the country where monies are earned does not contain a provision on the application of the progressive exemption method or if the double taxation treaty with this country was not concluded at all.

Our publications on double taxation agreements with Poland

Double taxation and exemption from tax liability

In addition to international double taxation agreements, taxpayers are also supported by domestic regulations, e.g. abolition relief allowance. The abolition relief allowance allows the amount of tax due to be reduced if no corresponding agreement on avoidance of double taxation has been concluded or if a method of proportional deduction that is less favorable to the taxpayer is provided for. However, due to new regulations limiting the abolition of this allowance, from 1 January 2021 Polish resident taxpayers (except sailors) earning in countries with which the proportional deduction method is applied under double taxation agreements, will pay in effect higher taxes, as the maximum amount of this allowance has been significantly reduced.