Accounting, Payroll

and Tax services in Poland

Your Trusted Partner in Poland - From Market Entry to Growth.

of Experience

Whether you are just starting your business in Poland or already established —

we provide legal, tax,

accounting, and HR expertise tailored to your needs.

Featured services

Accounting, HR and

Consultancy Outsourcing

getsix® offers accounting, bookkeeping and payroll services with a particular focus on the needs of medium-sized and large companies. We analyze current legal developments and advise on taxes and the latest legal changes in Poland.

We are members of international organisations of accounting offices and tax advisors, which enables us to support you in your foreign investments. For foreign investors in Poland we offer support in all activities related to setting up a branch or a company and running its accounting and HR departments.

The Customer Extranet is a central solution providing secure, 24/7 access to documents and shared resources. It also serves as a gateway to other services such as the Customer BI & Reporting Portal and Customer Invoice and Workflow Portal (available depending on the scope of cooperation).

Provides access to accounting and payroll data via interactive reports and analyses. The portal supports fast, data-driven business decision-making. As part of our accounting services, we provide two free reports that can be tested on the demo page.

A modern web platform and mobile app for managing invoice workflows, approvals, and verifications within your company. The portal ensures full control, security, and transparency at every stage of the process.

Symfonia HR Portal is an intuitive self-service platform that automates daily HR and payroll tasks. Managers get instant insight into team data, while HR teams gain greater control, transparency, and data security.

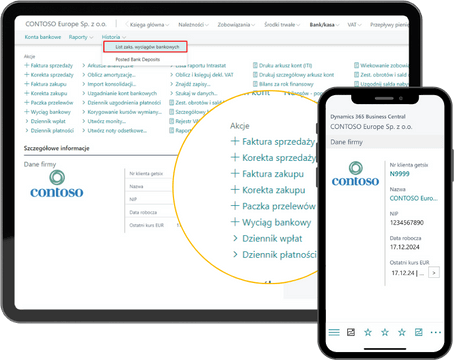

Dedicated to service companies, offering:

- Ready for KSeF implementation

- Automatic invoice posting

- Direct work in an enterprise-class ERP system

- Data ownership and full control

OUR SERVICES

Professional services aligned with your business goals – delivered

with precision and expertise.

hlb partner network

Audit, advisory and accounting

ranking

in Poland

in Poland

getsix® is a member of HLB International, a worldwide network of independent accounting firms and business advisers.

HLB is a global organization based on the collaboration of local firms, creating a cohesive network of experts worldwide. In Poland, this role is fulfilled by HLB Poland – a company that, through local expertise and global support, provides top-quality auditing services and solutions in finance and regulatory compliance.

Let our clients speak for us

"Everything was at the highest level."

— SEO Officer, Household Goods Retailer

"The combination of catering for me as a sole business person but with international requirements was..."

— Owner, Consulting Company

"They are always helpful and ready to support, offering high-level, up-to-date knowledge."

— CEO, item Polska sp. z o.o.

"All services are always performed on time."

— General Director, Ditzinger Sp. z o.o.

“Our communication has always been good thus far. Their team always replies promptly to our...”

— Financial Controller, Greenpack

"I'm very happy with them."

— EMEA Controller, Global Experience Specialists

Meet our team

The getsix® team consists of accountants, HR specialists, lawyers, tax consultants and IT experts. We select people whose competences complement each other to assist you in the best possible way.

Company Profile

Your trusted and reliable partner in Poland – getsix®, as an experienced and strong business partner, offers a broad range of cross-linked economic services for foreign investments in Poland. The service of our client will always stay the focal point of all the actions performed by getsix®.

READ MORE »

Investing in Poland

Comprehensive guide to the tax, legal and HR nuances of investing in Poland.

Ensures excellent decision-making for your business and helps you expand and succeed!

Latest News

March 9th, 2026

The National e-Invoicing System (KSeF) structured invoice for non-transaction transfers of own goods to an EU warehouse – is it required?

In Poland, the move to mandatory e-invoicing through the National e-Invoicing System (KSeF) is forcing businesses to revisit VAT scenarios that were previously treated as pure logistics. One of the most sensitive examples is the KSeF structured invoice for intra-Community transfers of own goods — i.e., moving your own stock from Poland to a warehouse…

March 6th, 2026

Partner remuneration for managing the company as hidden profits in Estonian CIT in Poland

Hidden profits in Estonian CIT in Poland are becoming an increasingly practical risk area — especially where a company (or partnership taxed under the Estonian model) settles recurring benefits with its partners. An amending interpretation issued by the Head of the National Revenue Administration (KAS) on 7 November 2025 (ref. DOP12.8221.9.2025) is a clear signal…

March 5th, 2026

National Bank of Poland interest rates in March 2026

On March 3-4, 2026, the Monetary Policy Council held a meeting during which it decided to decrease the National Bank of Poland (NBP) interest rates by 0.25 percentage points. Current National Bank of Poland interest rates: reference rate at 3.75% on an annual basis; lombard rate at 4.25% on an annual basis; deposit rate at 3.25% on an annual basis; rediscount…