Tax Services in Poland

We comprehensively advise on transfer pricing, its documentation thresholds (limits) and also on changes in 2022, including those related to the recently new changed Polish Deal on taxes.

Take advantage of our experience and professional tax advice on transfer pricing documentation!

The tax consulting services The tax consulting services on transfer prices aim at reducing the risk of having tax authorities questioning the prices used in the transactions with related entities. Within the scope of the transfer price consulting we offer the whole gamut of services starting with the examination of the factual status, the existing relations, contracts, and documentation to the optimization of group flows, to the preparation of tax documentation and the analysis of the transfer prices level. Within the framework of the tax optimisation we prepare relevant contracts; in this matter we can make use of our international connections.

Our consulting services on transfer prices include in particular the following activities:

- verification of and checking of the transactions concluded by the Company for the necessity of drawing up the tax documentation;

- verification of the documentation kept by the Company with the requirements resulting from the Act on corporate income tax;

- preparation of detailed tax documentation in compliance with the statutory requirements supporting the position of the taxpayer;

- preparation and implementation of the appropriate policy on transfer prices in the international and domestic transactions.

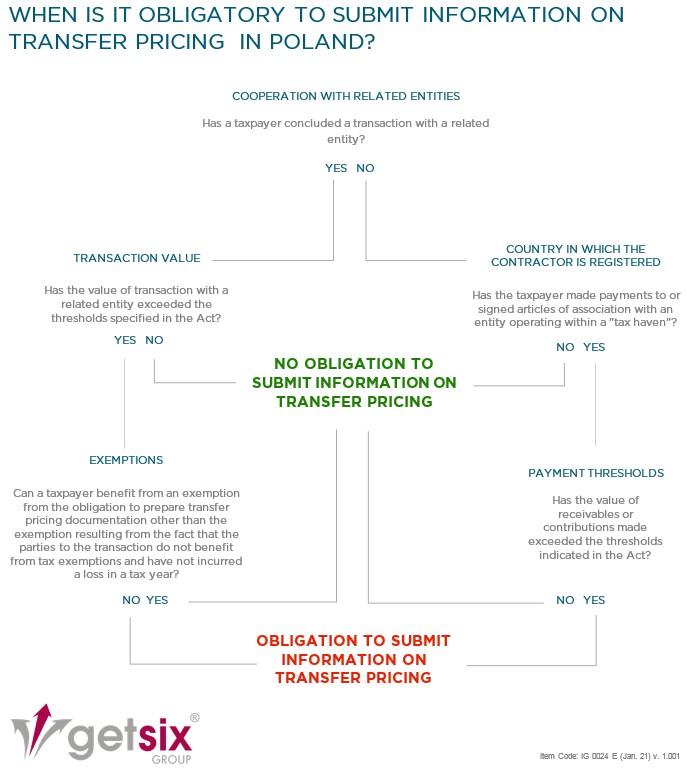

According to Polish law, under certain circumstances, two types of information on transfer pricing are required to be submitted independently of each other:

- Information on transfer pricing submitted to the Head of the National Revenue Administration;

- Statement on preparation of local transfer pricing documentation.

We help you understand legal complexities and prepare underlying documents.

Transfer pricing documentation support from getsix

Our transfer pricing documentation consulting services will help you to find your way in the new, fast-changing legal environment maintaining local transfer pricing documentation based on relevant applied thresholds. We have an interdisciplinary team of specialists and extensive experience in preparation of transfer pricing documentation. Our services are tailored to your individual needs.

Contact our transfer pricing documentation consultant!

Information on transfer pricing

The entities obliged to submit information on prices to the Head of the National Revenue Administration are:

- entities obliged to prepare local transfer pricing documentation;

- Polish related entities which fulfil the criteria for the obligatory preparation of local transfer pricing documentation, but are exempt from this obligation due to the fact that they do not benefit from tax exemptions and have not incurred a tax loss.

In order to check whether the obligation to submit information on transfer pricing arises, the following graphic diagram can be used:

What does information on transfer pricing include?

Information on transfer pricing includes:

- identification data of the entity submitting the information and the entity for which the information is submitted;

- general financial information of the entity for which the information is submitted;

- information on related entities and controlled transactions;

- information about the methods and transfer pricing.

The transfer pricing information will be in electronic format only. Read more…