Two types of information on transfer pricing

According to Polish law, under certain circumstances, two types of information on transfer pricing are required to be submitted independently of each other:

- Information on transfer pricing submitted to the Head of the National Revenue Administration;

- Statement on preparation of local transfer pricing documentation.

Information on transfer pricing

The entities obliged to submit information on prices to the Head of the National Revenue Administration are:

- entities obliged to prepare local transfer pricing documentation;

- Polish related entities which fulfil the criteria for the obligatory preparation of local transfer pricing documentation, but are exempt from this obligation due to the fact that they do not benefit from tax exemptions and have not incurred a tax loss.

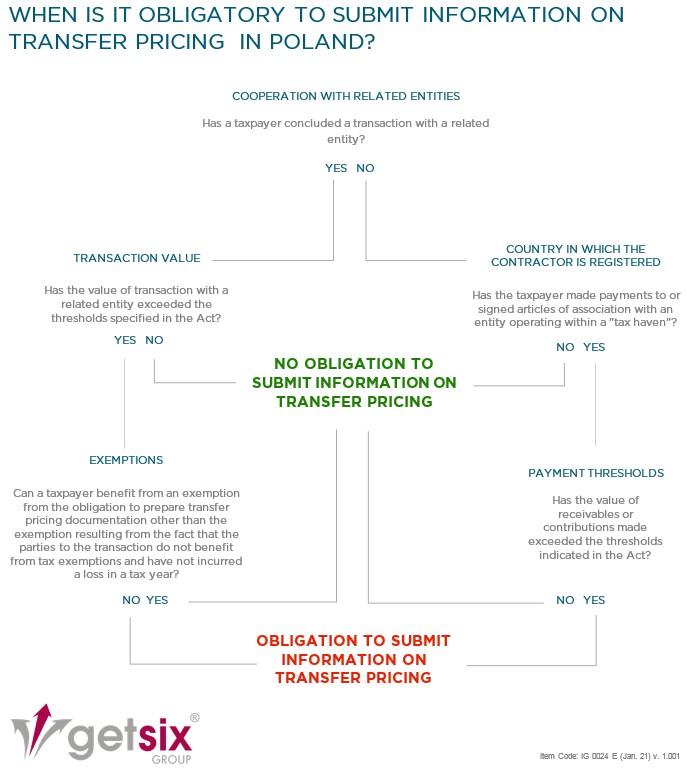

In order to check whether the obligation to submit information on transfer pricing arises, the following graphic diagram can be used:

What does information on transfer pricing include?

Information on transfer pricing includes:

- identification data of the entity submitting the information and the entity for which the information is submitted;

- general financial information of the entity for which the information is submitted;

- information on related entities and controlled transactions;

- information about the methods and transfer pricing.

The transfer pricing information will be in electronic format only.

What are the deadlines for submission of transfer pricing information?

Information on transfer pricing shall be submitted:

- by the end of the ninth month after the end of the tax year;

- in 2020 because of the COVID-19 pandemic:

- until 31st December 2020 – if the deadline was to expire between 31st March 2020 and 30th September 2020

- the deadline has been prolonged by three months if the deadline referred to in point (a) above was to expire between 1st October 2020 and 31st January 2021.

Failure to submit information on transfer pricing to the competent authority within the statutory deadline is subject to a fine of up to 120 daily rates. The daily rate in 2020 ranges from PLN 86.67 to PLN 34 668.

Statement on preparation of local transfer pricing documentation in Poland

Who has to submit a statement on preparation of local transfer pricing documentation?

The entities obliged to submit a statement on preparation of local transfer pricing documentation are related entities which are obliged to prepare local transfer pricing documentation.

Where should a statement on preparation of local transfer pricing documentation be submitted?

The statement shall be submitted to the tax authority. The statement on the preparation of local transfer pricing documentation shall be submitted by electronic means.

What should the statement on preparation of local transfer pricing documentation include?

In the statement on preparation of local transfer pricing documentation a related entity declares that:

- it has prepared local transfer pricing documentation;

- the transfer prices in controlled transactions included in the local transfer pricing documentation are set pursuant to the terms and conditions which would have been agreed upon by unrelated entities.

The statement shall be signed by a manager of the undertaking, as interpreted in the Accounting Act, while specifying their function, whereby:

- when several people fulfil the criteria for a manager of the undertaking or their designation is not possible, the statement is to be submitted and signed by each person authorised to represent a given entity.

- a statement cannot be made by an attorney.

What are the deadlines for submission of a statement on preparation of local transfer pricing documentation?

The statement on preparation of local transfer pricing documentation shall be submitted:

- by the end of the ninth month after the end of the tax year;

- in 2020 because of the COVID-19 pandemic:

- until 31st December 2020 – if the deadline was to expire between 31st March 2020 and 30th September 2020

- the deadline has been prolonged by three months if the deadline referred to in point (a) above was to expire between 1st October 2020 and 31st January 2021.

Penalties

Failure to submit the statement on preparation of local transfer pricing documentation within the statutory deadline or providing false information is subject to a fine of up to 720 daily rates.

If you have any additional questions about tax or require further information, please contact your relevant contact person who will forward your enquiry to the department:

Tax & Legal of the getsix Group

Our specialist tax advisors, headed by Mrs. Aneta, are at your disposal. You will find the contact form on the getsix website.

***