Dividend tax in Poland – regulations, rates and practical aspects

Dividend tax in Poland is a special type of withholding tax (WHT) collected at the time of payment of profits by a company to its partners or shareholders. There is no separate tax exclusively for dividends – they are treated as taxable capital income.

In practice, this means that both individuals and companies receiving dividends earn taxable income, and the obligation to collect and transfer it to the tax office rests with the paying entity.

In this article:

What is a dividend and when does the right to pay it occur?

A dividend is a portion of a capital company’s profit allocated for distribution among shareholders. The right to pay dividends arises after:

- approval of the financial statements,

- adoption of a resolution on the distribution of profit by the shareholders’ meeting or general meeting.

Although, as a rule, payments can only be made from net profit, funds may also come from supplementary or reserve capital. Alternatively, companies may, for example, redeem shares, which is similar to a dividend payment for tax purposes.

Standard dividend tax rate

In Poland, a 19% dividend tax rate applies. This is a flat-rate tax, independent of the taxpayer’s other income and not subject to the tax scale.

If a double taxation agreement (DTA) or EU regulations apply, this rate may be reduced or completely waived.

Dividend tax exemptions in the EU/EEA and Switzerland

Dividend tax exemption is possible if certain conditions set out in the Parent-Subsidiary Directive are met:

- the recipient is subject to income tax on its total income in its country,

- it does not benefit from tax exemption on its total income,

- it holds a minimum of 10% of the shares (25% in the case of Swiss companies) in the paying company,

- it has held the shares for at least 2 years (the period may be fulfilled after payment),

- it presents a valid tax residence certificate,

- it submits a statement confirming that the above conditions are met.

SAAR – anti-abuse clause for dividend tax

Since 2016, an anti-abuse clause (SAAR) has been in force in Poland. This means that dividend tax exemptions will not apply if the main purpose of the legal structure is to achieve a tax advantage and the transaction has no real economic justification.

The tax authorities may refuse the exemption if the recipient:

- does not conduct actual economic activity,

- has no employees or economic resources,

- acts solely as an intermediary company.

According to the explanations of the Ministry of Finance of 3 July 2025, in the case of dividends as ‘passive payments’, the application of WHT preferences (exemptions, reduced rates) generally requires verification of the status of the beneficial owner.

At the same time, the case law of the Supreme Administrative Court remains inconsistent:

- Judgment of the Supreme Administrative Court of 9 October 2024 (II FSK 78/22) – it was stated that in the case of dividend exemption under Article 22(4) of the CIT Act, the payer is not obliged to verify the status of the beneficial owner.

- NSA judgment of 6 May 2025 (II FSK 1082/22) – the court ruled that the payer must verify all the conditions for the exemption, including the status of the beneficial owner of the dividend recipient.

As a result, the practice proper attention and good documentation, especially in the event of a discrepancy between the case law and the position of the Ministry of Finance.

Foreign dividends and Polish dividend tax

Dividend tax also applies to income from abroad. In the case of dividends received from other countries, it is necessary to check whether Poland has concluded a double taxation agreement (DTA) with the country in question.

- The agreement may provide for a lower tax rate (e.g. 5%, 10% or 15%) or a total exemption.

- To benefit from it, you must have a valid certificate of residence.

- If you do not have one, the full rate of 19% applies.

- Foreign dividends must also be reported in your Polish tax return, with the possibility of deducting tax paid abroad.

Company obligations when paying dividends

The company acts as a payer and is obliged to:

- collect tax on dividends,

- transfer it to the tax office by the 7th day of the month following the month in which the tax was collected,

- submit the CIT-6R declaration by the end of the first month after the end of the tax year and the IFT-2R declaration by the end of the third month after the end of the tax year,

- collect and verify the documents necessary to apply for the exemption (certificates, statements).

Additionally, if the total amount of payments to a single related entity in a tax year exceeds PLN 2 million, the ‘pay & refund’ mechanism applies. This means that, as a rule, the company collects the full withholding tax, and the taxpayer may apply for a refund or use the WH-OSC procedure or an opinion on the application of preferences.

Find out more: Pay & Refund in Poland – a complicated withholding tax (WHT) refund procedure

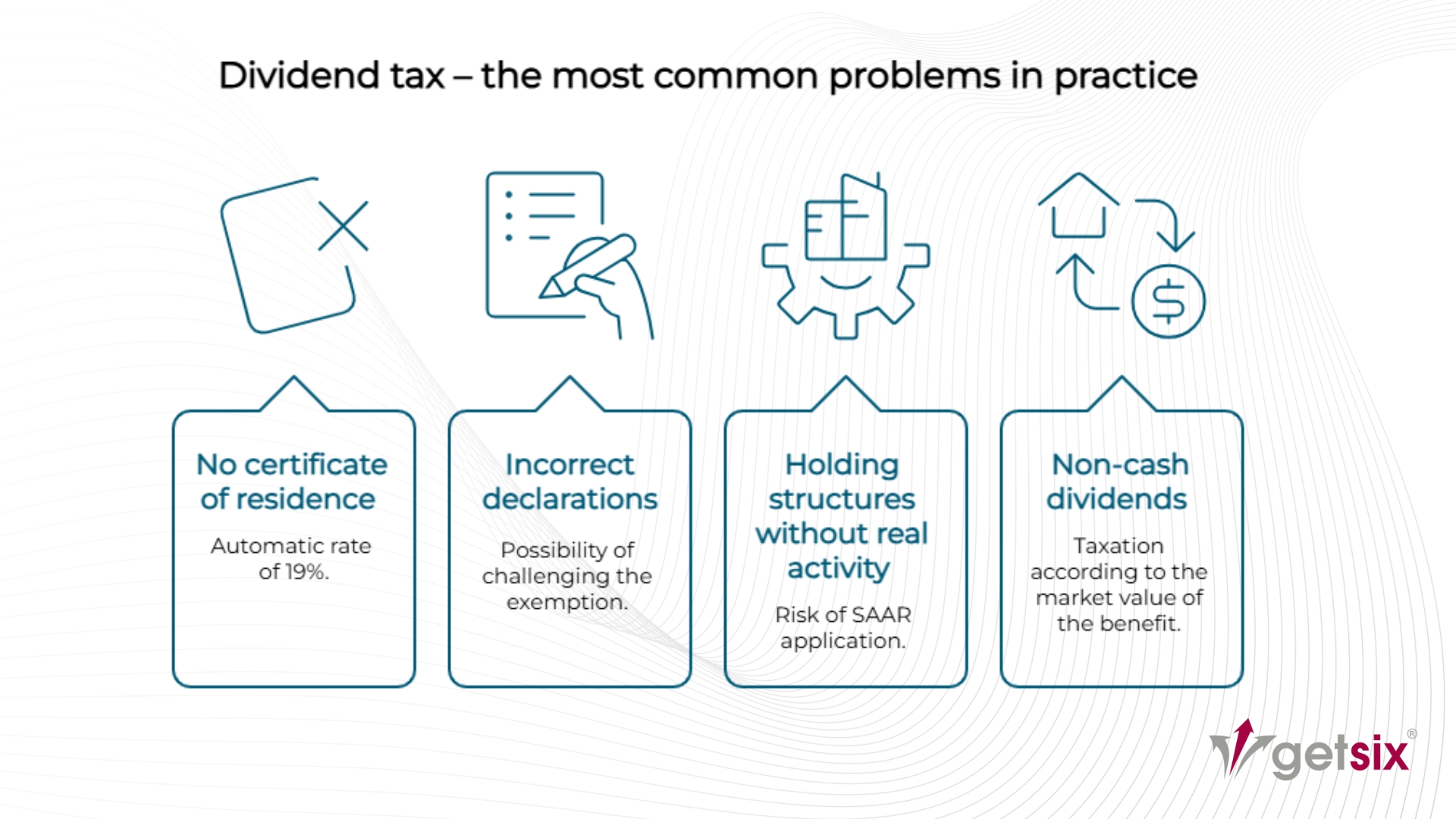

Dividend tax – the most common problems in practice

- No certificate of residence → automatic rate of 19%.

- Incorrect declarations → possibility of challenging the exemption.

- Holding structures without real activity → risk of SAAR application.

- Non-cash dividends (e.g. in the form of real estate) → taxation according to the market value of the benefit.

Frequently Asked Questions

1. How much is the dividend tax in Poland?

2. Do I have to settle the tax on dividends myself?

3. How to settle foreign dividends in Poland?

4. Is there a dividend tax exemption?

5. When does the obligation to pay tax on dividends arise?

6. Do dividends in kind also have to be taxed?

7. Can a natural person benefit from dividend tax exemption?

8. What documents are required to benefit from the dividend tax exemption?

9. Can the dividend tax be reduced?

10. What is the pay & refund mechanism for dividend tax?

Dividend tax in Poland is an important element of the tax system, directly affecting individual and institutional investors. The standard rate of 19% applies in most cases, although international agreements and EU regulations may provide more favourable terms.

In practice, the most important thing is to have the correct documentation (certificates of residence, declarations) and to prove that the recipient is the actual owner of the dividend. Proper application of these rules minimises tax risk and allows you to take advantage of the available preferences.

If you have any questions regarding dividend tax or need support in optimising your tax settlements, getsix® can help. We analyse your tax situation and provide comprehensive advice tailored to your individual needs to ensure compliance and tax security.

Legal basis:

- Act of 15 February 1992 on corporate income tax (Journal of Laws 1992 No. 21 item 86, as amended)

- Act of 26 July 1991 on personal income tax (Journal of Laws 1991 No. 80 item 350, as amended)

- Council Directive 2011/96/EU of 30 November 2011 on the common system of taxation applicable in the case of parent companies and subsidiaries of different Member States

If you have any questions regarding this topic or if you are in need for any additional information – please do not hesitate to contact us:

CUSTOMER RELATIONSHIPS DEPARTMENT

ELŻBIETA

NARON-GROCHALSKA

Head of Customer Relationships

Department / Senior Manager

getsix® Group

***