BWA Report – The key to understanding your company’s financial condition

How well do you know the current financial situation of your business? Are you confident that you are up to date with the most important data that could impact your business decisions? The BWA report is a tool that provides information about revenues, costs, and profitability in real time. Regular analysis of this data enables quick identification of issues, such as rising operational costs or declining revenues. This allows you to take immediate action, such as reducing expenses in areas that aren’t profitable or increasing investments in promotional activities to boost sales. What other benefits come from continuously monitoring financial performance? Read on to learn how the BWA report can help improve the efficiency of your business.

What is the BWA report?

BWA, which stands for betriebswirtschaftliche Auswertung (business management assessment), is a financial data summary that provides entrepreneurs with detailed information about their company’s current financial condition for any given period. Prepared on the basis of accurate data, this report includes indicators such as revenue, costs, profits, and liquidity level. This allows the entrepreneur to monitor profitability in real time and identify areas that need improvement.

One of the greatest advantages of the BWA report is its regularity – it is usually prepared monthly. This frequency allows for quick responses to changes in the company’s financial situation. For example, if the report shows an increase in costs, the entrepreneur can immediately take actions to reduce or optimize them.

It is also important to note that the BWA report is not a substitute for the annual financial statement but rather a tool that supports daily financial management. It enables entrepreneurs to better understand how their business is performing in the short term and compare results with previous months or years. This allows for more effective planning of future steps, which promotes informed business decisions.

Background to the BWA report

The concept of the BWA report was created in the 1960s by the company DATEV, which introduced the first set of financial data in the DATEV BWA-Form 01 format (DATEV-Standard-BWA). Since then, the BWA report has become one of the most widely used models for financial analysis by small and medium-sized enterprises in Germany. DATEV, as the developer of this solution, is also the leading provider of BWA reports in the German market, although other providers also offer similar tools. In recent years, the BWA report has gained popularity outside Germany, where entrepreneurs are increasingly recognizing its value in monitoring financial situations and identifying areas of business that require optimization.

Types of BWA reports

There are several types of BWA reports to suit different industries and business needs. The most commonly used type is the previously mentioned Standard-BWA, which, thanks to its universal nature, is suitable for businesses of all sizes and industries. This report allows the figures to be analysed purely from the perspective of economic criteria – it focuses only on universal financial indicators, but does not take into account factors specific to individual industries or forms of business.

However, if an entrepreneur requires more specific analyses tailored, for example, to the requirements of industry or company size, many providers also offer other types of BWA reports, including:

- Controllingreport-BWA (Controlling report): Combines the analysis of current financial results with a cash flow statement. It is primarily aimed at those involved in corporate financial analysis and supervision, as it provides a basis for monitoring the financial condition of the company.

- Einnahmen-Ausgaben-BWA (Revenue and expenditure report): Provides a simplified analysis of the profit and loss statement, which is particularly useful for businesses that are just starting and do not exceed specific revenue and expenditure limits.

- Kapitalflussrechnung-BWA (Cash flow statement report): Focuses on the analysis of cash flows within the company, which is crucial when applying for loans or other forms of financing, as banks and financial institutions often assess creditworthiness based on liquidity data.

What is included in the BWA report?

The BWA report includes all key financial data of the company presented on a periodic basis. The standard BWA report is organized in a tabular format and divided into several sections, corresponding to the main elements of the profit and loss statement. It typically includes the following areas:

- Sales revenue,

- Gross profit,

- Types of expenses,

- Financial expenses or financial income,

- Taxes,

- Earnings before interest and taxes (EBIT).

Careful selection of data and indicators is important to get a reliable and accurate picture of a company’s financial condition.

Importance of the quality of the accounting books for the BWA report

The value of the BWA report depends to a large extent on the quality of the company’s accounting books. The more accurately financial records are kept, the more reliable the results presented in the report will be. The BWA report must not contain more information than what is contained in the accounting books of the company in question. To ensure that the report provides accurate results, attention should be given to:

- Correct allocation of data to the appropriate accounts and proper accounting

- Even distribution of depreciation over time,

- Periodic valuation of work in progress and finished products,

- Proper allocation of costs to the correct periods.

Furthermore, an equally important issue is the timeliness of bookkeeping, which many companies have problems with. Regular accounting of transactions, including payables and receivables, is key to the quality of the BWA report. Only up-to-date and accurate financial data can reliably reflect the actual financial condition of the company. Delays in accounting can lead to inaccuracies in presented results, which affects wrong business decisions. Therefore, it is worth considering working with a professional accounting office that ensures the timely processing of all transactions and guarantees high-quality bookkeeping.

Who can benefit from BWA reports?

The primary recipients of BWA reports are business owners, including self-employed, partners of partnerships, and board members of corporations. Although these entrepreneurs have access to annual financial statements, they often receive important data too late to effectively respond to emerging negative trends, such as declining revenue, rising operational costs, or liquidity problems. With the BWA report, an entrepreneur has a regular overview of the most important data, such as current revenues, expenses, and profitability indicators, allowing for faster decision-making, e.g., cutting costs or investing in new projects. Additionally, in situations such as credit negotiations or the conclusion of agreements with large contractors, the BWA report can be used to provide an overview of the companies’ current financial situation and thus increase the chances of obtaining favourable terms of cooperation. Creditors, including banks, also require up-to-date financial data, and the BWA report can serve as a reliable source of information to confirm the creditworthiness of an entrepreneur.

Sample BWA reports for your business

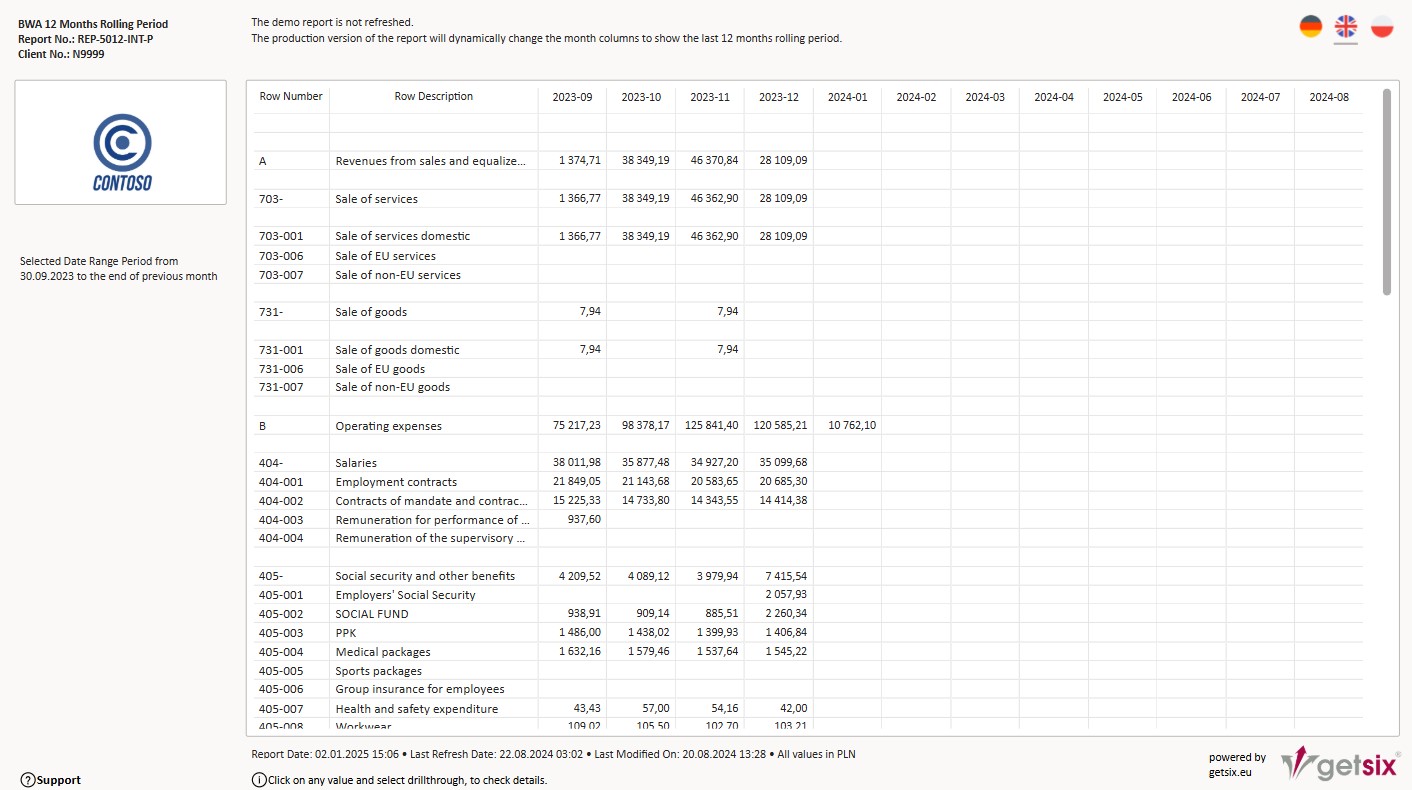

If you’re interested in the previously discussed aspects of BWA reports, you can explore sample versions of these reports available in the Customer BI and Reporting Portal by getsix®. Reviewing these reports will help you better understand how this tool can support effective financial management in your company.

getsix® reports are based on accurate data and cover a variety of areas, such as sales revenue, operational expenses, profit or loss on sales, operating and financial results, gross profit, income tax, and net result of the company. The report layout is customizable to suit the company’s needs, but its structure is quite universal. Columns typically represent different periods, while rows are divided into sections corresponding to various financial areas, such as revenues and costs, which can further be divided into cost accounts.

Regular access to BWA reports can enable the quick identification of areas that need improvement and help you make informed business decisions. For example, a comparative analysis with last year’s data can reveal whether the revenue achieved is in line with planned sales targets. This insight may prompt adjustments to your company’s marketing strategy or increased investment in product development to improve financial performance.

- REP-5002-INT-P-N9999 BWA 12 Months – This report covers financial data for the last 12 months.

- REP-5012-INT-P-N9999 BWA 12 Months Rolling Period – This report includes data for a rolling 12-month period.

- REP-5014-INT-P-N9999 BWA Previous Year Comparison – This report allows you to compare financial data with the previous year’s data.

- REP-5015-INT-P-N9999 BWA 3 Year Comparison – This report compares financial results for the past three years.

Summary – Tips for entrepreneurs

- Use the BWA reports regularly as a tool to monitor the financial condition of your business. These reports provide quick access to information on revenue, costs, and profitability. This allows you to detect any concerning changes in financial performance and react quickly to problems.

- Analyze operational costs and implement optimization measures if you notice an increase. Always pay attention to changes in the cost structure—an increase may signal the need for process optimization. If you notice any unjustified or excessive expenses, act immediately to prevent further issues.

- Compare data with previous years to evaluate whether your revenues meet sales targets. Regularly comparing financial results with past years lets you assess whether your company is growing at the expected pace. If revenues are not growing as planned, it’s time to consider adjustments to your strategy.

- Ensure the quality of bookkeeping – accurate data is crucial for the credibility of BWA reports. If your bookkeeping is inaccurate, it can lead to incorrect conclusions and decisions. So investing in good bookkeeping is investing in a better future for your business.

- Identify areas for improvement in the business, for example by analyzing costs and revenues in different departments. Knowing which areas are underperforming allows you to focus on optimizing them and implementing effective solutions. This approach increases profitability and improves the financial stability of the company.

The company getsix® Services has been an integral part of the getsix® Group for nearly 20 years, enabling them to provide tested and refined solutions for clients in the service industry who require efficient accounting and financial controlling solutions.

If you have any questions regarding this topic or if you are in need for any additional information – please do not hesitate to contact us:

CUSTOMER RELATIONSHIPS DEPARTMENT

ELŻBIETA

NARON-GROCHALSKA

Head of Customer Relationships

Department / Senior Manager

getsix® Group

***