Exports in Poland in July 2025 – holiday slowdown, stable outlook

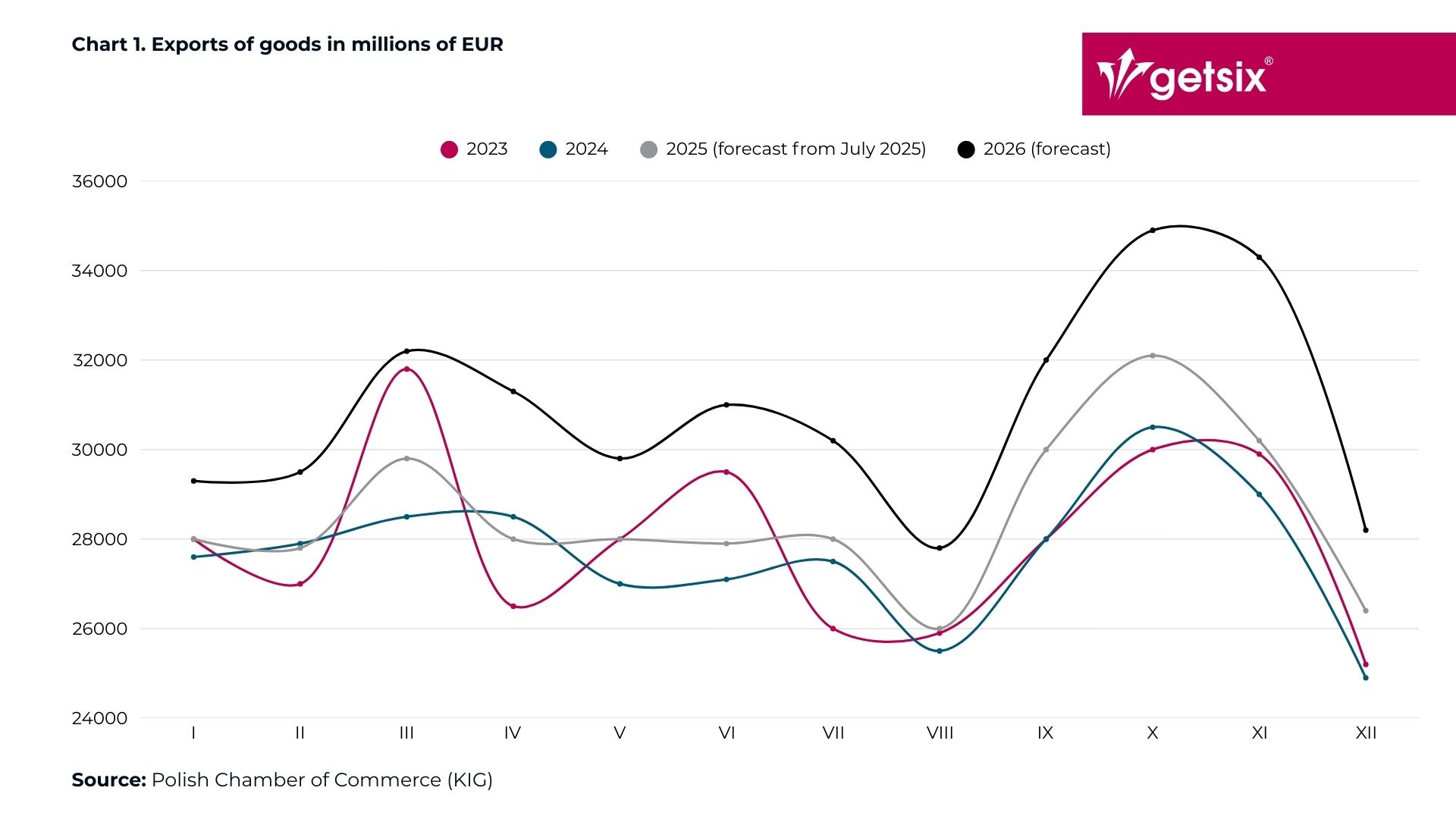

In July 2025, exports in Poland amounted to EUR 27.9 billion. This is less than in June (-0.4% m/m), but more than a year earlier (+1.7% y/y) – a classic holiday seasonality, when some plants are shut down and supply chains are slower. However, the forecasts of the Polish Chamber of Commerce (KIG) remain good: exports are expected to grow by approx. 3.2% for the whole of 2025 and by as much as 7.8% in 2026.

In this article:

July marked by seasonality

July is a month when the pace of work in exports usually slows down. Many plants take advantage of the holiday break, and production lines undergo inspections and servicing. Trade is not yet preparing for autumn deliveries, so orders are lower than in spring or autumn.

This year, the data looks similar: compared to June, exports fell by 0.4%, but compared to July last year, they increased by 1.7%. This means that despite the temporary holiday break, Polish companies are still doing well on foreign markets.

Currencies and competitiveness

Exporters are also affected by exchange rates. According to data from the National Bank of Poland, the average euro exchange rate in July was PLN 4.2542, which meant a slight strengthening of the zloty compared to June (+0.26%).

The zloty gained even more against the dollar, reaching PLN 3.6384 (an increase of 1.74% m/m). For companies settling sales in euros, this poses certain pricing challenges, but at the same time, the cheaper dollar reduces the cost of importing raw materials and components, which partially offsets the effect of the stronger currency.

Dynamics of the first half of the year

The first six months of 2025 confirmed the stable direction of Polish foreign trade. Exports reached almost EUR 180 billion, which is 1.6% more than a year earlier. This is a moderate but important increase, as it was achieved despite the weaker economic situation in Europe and a stronger currency. The recovery in Germany, which remains our main trading partner and often sets the pace for Polish exports, will be particularly important.

Exports in Poland – outlook for the second half of 2025 and 2026

The Polish Chamber of Commerce emphasises that the July slowdown is temporary. The expected recovery in demand among key partners, primarily in Germany, should translate into an increase in orders. Added to this are the still visible effects of supply chain shortening (‘nearshoring’), which favour suppliers from the EU, including Poland. In annual terms:

- 2024: exports fell from EUR 335.4 billion to EUR 332.7 billion (-0.8%).

- 2025 (Polish Chamber of Commerce forecast): EUR 343.3 billion (+3.2% y/y).

- 2026 (Polish Chamber of Commerce forecast): EUR 370.0 billion (+7.8% y/y).

‘July traditionally brings a slight weakening of exports, but annual comparisons remain positive… The recovery of our trading partners, especially in Germany, will be key,’ says Piotr Soroczyński, chief economist at the Polish Chamber of Commerce.

How to prepare your company for the second half of 2025?

- Currency exchange rate hedging

If you conclude contracts in euros, it is worth considering provisions in the contract that allow you to adjust the price to exchange rate changes (so-called indexation clauses). Another solution is to use financial instruments that protect against exchange rate risk (hedging). On the other hand, when purchasing raw materials in dollars, it is worth taking advantage of the current strengthening of the Polish zloty – this is a time when components from the US or Asia are cheaper for us.

- Preparing production for autumn

After the summer slowdown, it is worth ensuring flexibility in increasing production capacity. In autumn, the number of orders usually increases, especially from German customers. It is a good idea to plan in advance how quickly you can increase the pace of work and adapt to higher demand.

- Emphasising the advantage of proximity

Companies in the European Union increasingly prefer to buy from suppliers in neighbouring countries rather than from distant Asian markets. Poland has a significant advantage here – shorter delivery times, lower risk of delays and compliance with EU requirements. It is worth communicating this clearly in offers to foreign contractors.

getsix® offers comprehensive support for businesses – from accounting and HR and payroll services, through tax advice, to assistance in registering and running a business in Poland. Thanks to our knowledge of local regulations and experience in working with foreign clients, we provide entrepreneurs with a solid foundation for growth and expansion into foreign markets.

Although July brought a natural slowdown due to the holiday season, the outlook for exports in Poland remains good. Data from the Central Statistical Office (GUS), the National Bank of Poland (NBP) and forecasts by the Polish Chamber of Commerce (KIG) indicate that we can expect a rebound in the second half of the year and, in the longer term, a significant increase in foreign sales. This is an important signal for entrepreneurs that Poland remains competitive on international markets, despite changing economic conditions and exchange rate fluctuations.

If you have any questions regarding this topic or if you are in need for any additional information – please do not hesitate to contact us:

CUSTOMER RELATIONSHIPS DEPARTMENT

ELŻBIETA

NARON-GROCHALSKA

Head of Customer Relationships

Department / Senior Manager

getsix® Group

***