Deposit-refund system 2025 in Poland – how should your business prepare for the upcoming changes?

On 1 October 2025, Poland will implement a deposit return system for selected beverage containers. This marks one of the most significant reforms in Poland’s waste management in recent years. While the primary goal is environmental – increasing recycling rates and reducing waste – the impact on businesses will be tangible: new obligations, logistical processes, and the need to adapt sales systems. Find out how the deposit system works and what actions businesses should take.

In this article:

A new system – for whom, why and how?

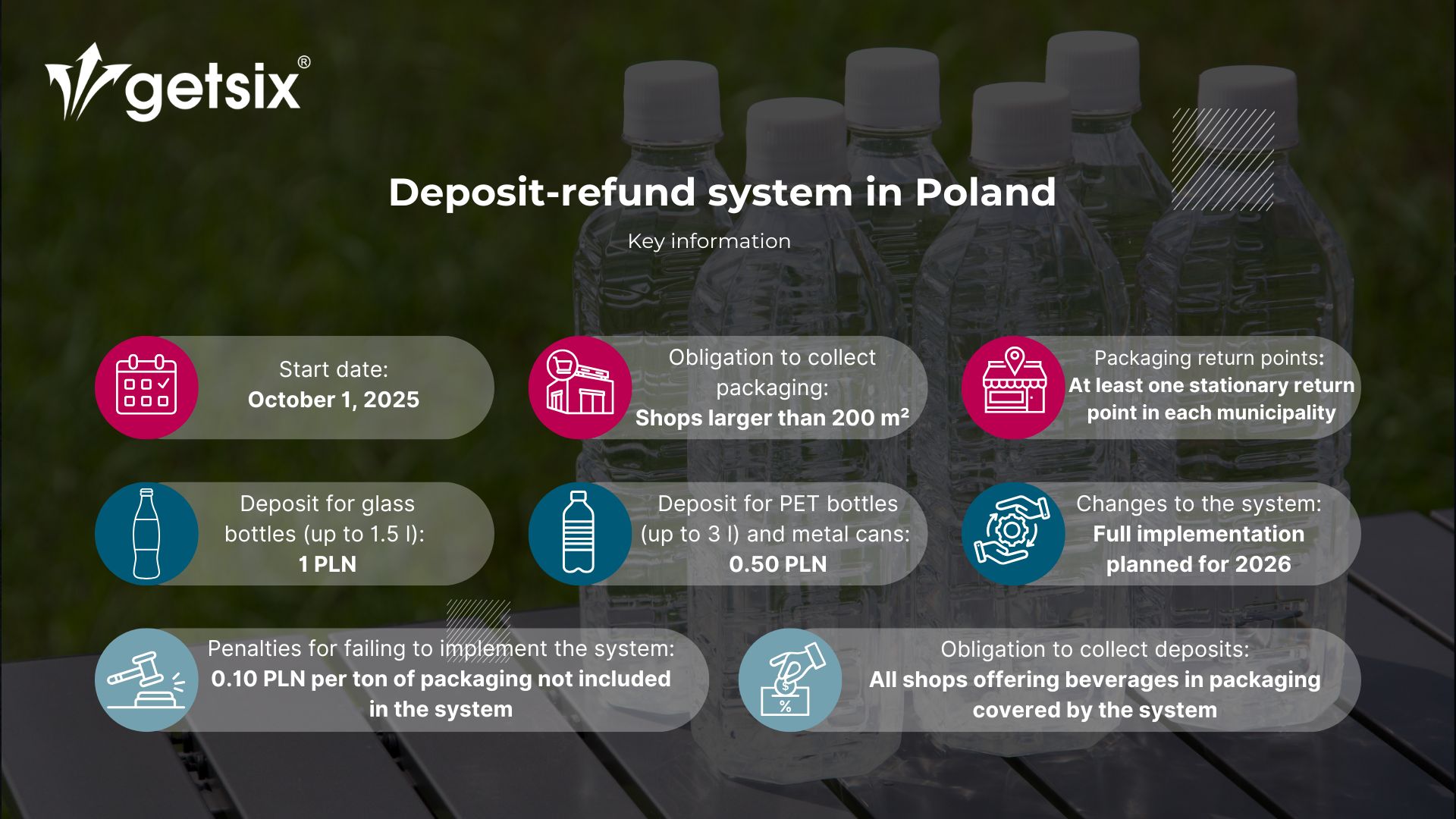

The deposit system will apply to all beverages sold in certain containers – plastic PET bottles up to 3 litres, metal cans up to 1 litre, and reusable glass bottles up to 1.5 litres. The aim is to achieve EU targets for separate collection – 77% already by 2025 and 90% from 2029.

The system will benefit the environment and consumers, but it will not be neutral for businesses. Obligations for beverage producers, retailers, and system operators are extensive: from organising collection and managing financial settlements to customer education. Regardless of company size, appropriate preparation will be crucial.

Who will be covered by the deposit-refund system?

The system will apply to entities in Poland placing beverages on the market in packaging (producers, importers, distributors) as well as retail outlets. The scope of obligations varies depending on the business profile and shop size:

- Shops over 200 m² – must accept used containers and refund the deposit to customers.

- Shops under 200 m² – may voluntarily join the system, but from 2026 they will be required to collect reusable glass bottles.

- Beverage introducers (over 100,000 containers per year) – are obliged to join the system or pay a product fee (which will be significantly higher from 2026).

What types of packaging will be included?

The deposit-refund system covers three packaging categories:

- Single-use plastic bottles up to 3 litres (PET),

- Metal cans up to 1 litre,

- Reusable glass bottles up to 1.5 litres.

Deposit amounts:

- PLN 0.50 – PET bottles and cans,

- PLN 1.00 – reusable glass bottles.

How the system works – key information

- The system will be receipt-free – deposits will be refunded based on packaging markings.

- Deposits will be added at the checkout, not included in the shelf price.

- Packaging can be returned at any collection point, not necessarily where purchased.

- All packaging must carry a special logo indicating system coverage.

- Packaging must not be crushed – the label must be legible.

- A transition period will apply until the end of 2025, during which beverages without new markings may still be sold.

Obligations for businesses – what needs to be prepared?

For shops and beverage producers, the system means a range of new obligations:

Retailers:

- Designate space for returns (manual or via reverse vending machines),

- Ensure logistical and accounting support for returns,

- Train staff,

- Adapt sales (e.g. POS) and ERP systems.

Beverage producers/importers:

- Sign a contract with a deposit system operator,

- Label products with the appropriate logo,

- Keep records of deposits collected and refunded,

- Reconcile with deposit system operators.

Operators – who will manage the system?

Unlike solutions in Germany or Scandinavian countries, the Polish system will be operated by several independent private entities. So far, permits have been granted to:

- PolKa S.A.

- ZWROTKA S.A.

- OK Operator Kaucyjny S.A.

- EKO-OPERATOR S.A.

- Reselekt S.A.

- Polski System Kaucyjny S.A.

These operators will be responsible for collection, transport, recycling, deposit settlement, and building collection infrastructure at the local level.

Deposit system – tax and reporting obligations

Although deposits won’t be added to the product price and VAT will not be charged to customers, the system will require businesses to maintain accurate VAT records – particularly regarding unclaimed deposits. Producers and operators will be required to:

- Maintain records of deposits collected and refunded,

- Modify ERP systems accordingly,

- Update accounting and reporting procedures,

- Integrate deposit mechanisms into JPK_VAT (as soon as regulatory details are finalised).

It is also essential to ensure properly worded agreements with system operators – since the law does not specify contract content, businesses must protect their interests independently.

What are the potential benefits for businesses?

The deposit-refund system presents both a challenge and an opportunity. Companies that successfully implement the new requirements can benefit from:

- A stronger brand image (eco-responsibility, sustainability),

- Greater customer loyalty among environmentally conscious consumers,

- More efficient packaging management processes.

Conversely, lack of preparation may result in financial penalties, organisational disruption, and increased costs from 2026 onwards.

The deposit-refund system, set to launch in Poland on 1 October 2025, represents a major shift – not only environmentally, but also operationally and financially. It will impact producers, importers, and retailers alike – regardless of store size.

Implementing the system will require adjustments in sales, logistics, and record-keeping processes, signing agreements with operators, and ensuring proper product labelling. These changes should be seen not only as a compliance burden, but also as an opportunity – to strengthen brand image, enhance customer loyalty, and implement innovative packaging practices.

Failing to prepare may lead to higher fees and sanctions as early as 2026. It is therefore worth acting in advance and ensuring full compliance with the new regulations.

If you have any questions regarding this topic or if you are in need for any additional information – please do not hesitate to contact us:

CUSTOMER RELATIONSHIPS DEPARTMENT

ELŻBIETA

NARON-GROCHALSKA

Head of Customer Relationships

Department / Senior Manager

getsix® Group

***