Car depreciation limits in Poland from 2026 – changes and implications for entrepreneurs

From 2026, the use of passenger cars in business in Poland will become less tax-efficient. New depreciation limits and rules for recognising costs – directly linked to CO₂ emissions – will significantly change how Polish companies can include vehicles in their tax-deductible expenses.

Starting from 1 January 2026, new depreciation thresholds and cost recognition rules will apply in Poland – both for purchased vehicles and for those acquired through leasing or rental. A key determinant will be the CO₂ emissions of each vehicle: the higher the emissions, the smaller the portion of its value that will be tax-deductible. This will negatively impact most petrol, diesel and conventional hybrid cars. Only low-emission vehicles – primarily electric and hydrogen-powered – will continue to benefit from preferential tax treatment.

In this article:

New depreciation limits in Poland – who gains, who loses?

From 1 January 2026, Polish tax law will introduce new depreciation caps, based on CO₂ emissions. These changes will also affect operating leases and long-term rentals.

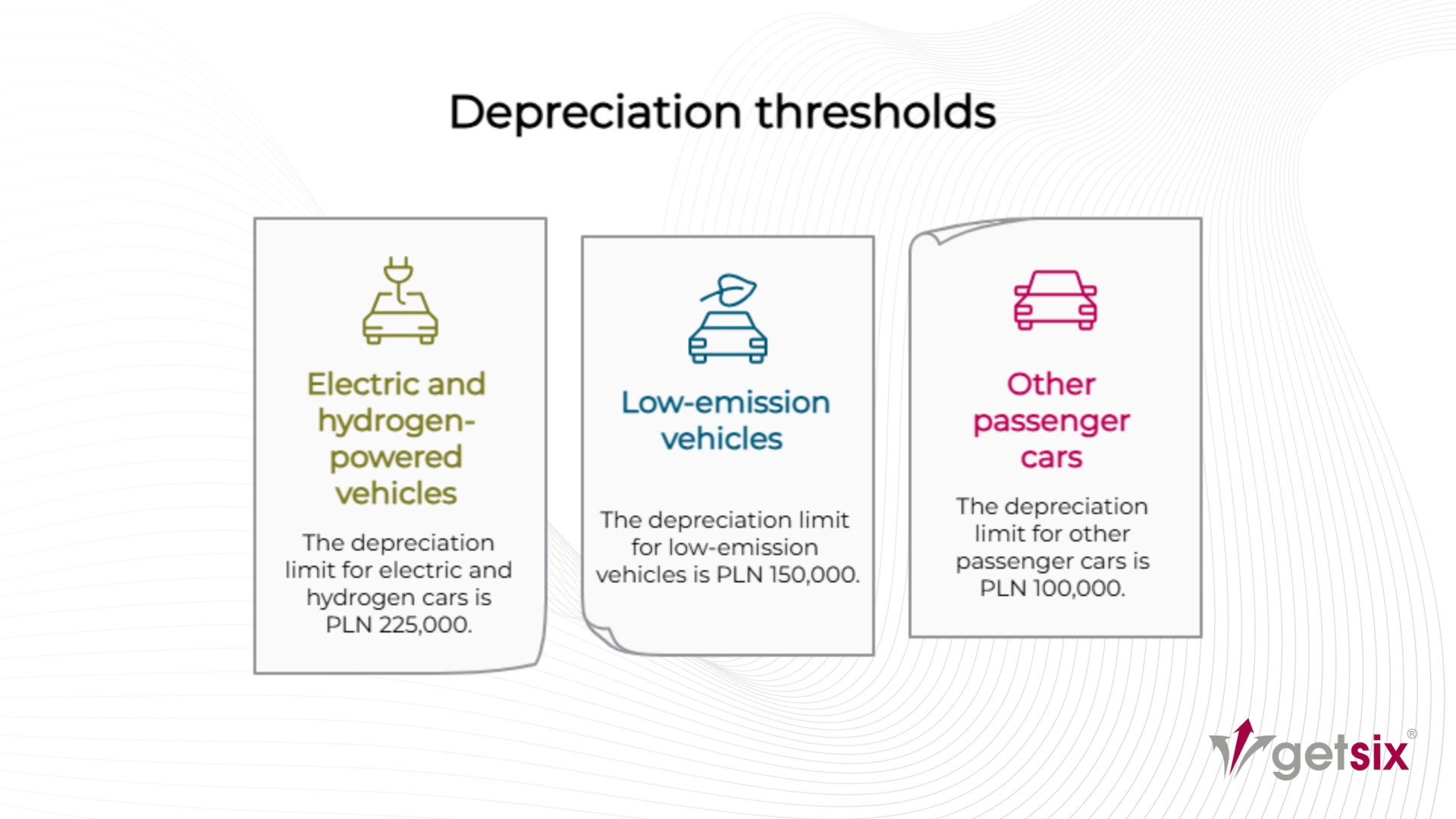

Depreciation thresholds under Polish tax regulations:

- PLN 225,000 – unchanged limit for electric and hydrogen-powered vehicles.

- PLN 150,000 – retained for low-emission vehicles with CO₂ emissions of no more than 50 g/km (mostly selected plug-in hybrids).

- PLN 100,000 – newly introduced, significantly lower limit for all other passenger cars, i.e. most petrol, diesel and conventional hybrid vehicles.

Important notes:

- These limits will apply only to vehicles entered into the fixed assets register in Poland after 31 December 2025.

- Vehicles accounted for before that date will remain under the current Polish rules.

- For many companies operating in Poland, this will reduce the scope of car-related tax deductions and lead to higher CIT liabilities in the following years.

How to verify emissions in Poland?

The applicable depreciation limit for a vehicle in Poland will depend on its official CO₂ emissions, based on technical data recorded in the Central Vehicle Register (CEPiK). These figures are taken from type approval documents. Therefore, businesses in Poland should verify a car’s emissions before purchase to assess tax consequences accurately.

Leasing and rental in Poland – what you should know

Although the new depreciation limits are clearly defined for fixed assets, Polish legislation currently lacks transitional provisions for operating leases and long-term rentals. It remains unclear whether a lease contract concluded in 2025 will allow a company to apply the current cost limits (e.g. PLN 150,000) after 1 January 2026.

This uncertainty creates a tax risk, particularly for businesses in Poland planning larger fleet investments. Entrepreneurs should closely monitor guidance from the Polish Ministry of Finance and seek tax advisory support where needed.

Risk of tax scheme classification (MDR)

Acquiring a vehicle before the end of 2025 solely to take advantage of higher depreciation limits could – under Polish regulations – be classified as a reportable tax arrangement (MDR). This applies especially where:

- The purchase is not justified by actual business needs.

- The transaction is made shortly before the year-end and appears driven solely by tax optimisation.

In such situations, Polish businesses are strongly advised to consult with a tax adviser in advance to avoid unintended non-compliance with mandatory disclosure requirements.

Legislator’s objective behind the amendment in Poland

According to the explanatory memorandum to the amendment, the primary objective of the changes is to promote low-emission transport and accelerate the transformation of corporate fleets towards electric and hydrogen-powered vehicles. The new regulations aim to encourage entrepreneurs in Poland to move away from conventional combustion-engine cars in favour of more environmentally friendly alternatives.

The introduction of differentiated depreciation and leasing cost limits – based on CO₂ emissions – is intended to support the development of the electromobility market in Poland. The legislator argues that a preferential approach to low-emission vehicles should help offset their higher purchase price and support the environmental objectives linked to the EU’s climate policy.

A fiscal element also underpins these changes – according to the regulatory impact assessment, the new rules are expected to generate additional state revenue of several billion Polish zlotys over a six-year period.

The depreciation limit changes coming into force on 1 January 2026 in Poland will significantly reduce the tax benefits of combustion-engine cars for business use. For many companies, this will mean higher taxable income and less attractive conditions for purchasing, leasing or renting vehicles in Poland. Tax incentives will remain only for low-emission vehicles – mainly electric and hydrogen-powered – which supports climate policy goals but may burden businesses reliant on conventional transport.

If you are considering investing in a company fleet or purchasing a business vehicle in Poland before the end of 2025, it is advisable to act in advance and consult with a local tax adviser. The absence of detailed transitional rules and the risk of triggering MDR obligations mean that well-informed planning is essential.

If you have any questions regarding this topic or if you are in need for any additional information – please do not hesitate to contact us:

CUSTOMER RELATIONSHIPS DEPARTMENT

ELŻBIETA

NARON-GROCHALSKA

Head of Customer Relationships

Department / Senior Manager

getsix® Group

***