National E-Invoicing System (KSeF) in Poland – summary of work and full schedule of changes. What has already happened and what else awaits entrepreneurs?

The National e-Invoice System (KSeF) in Poland is one of the most complex digitisation projects implemented in the Polish administration in recent years. Its aim is to standardise the circulation of invoices, increase data security, speed up accounting processes and automate settlements. At the end of November 2025, work on the system is entering a decisive phase – on the one hand, most of the key components have already been made available to users, and on the other, a period of intensive preparations for the mandatory National E-Invoicing System (KSeF) 2.0 in 2026 is beginning.

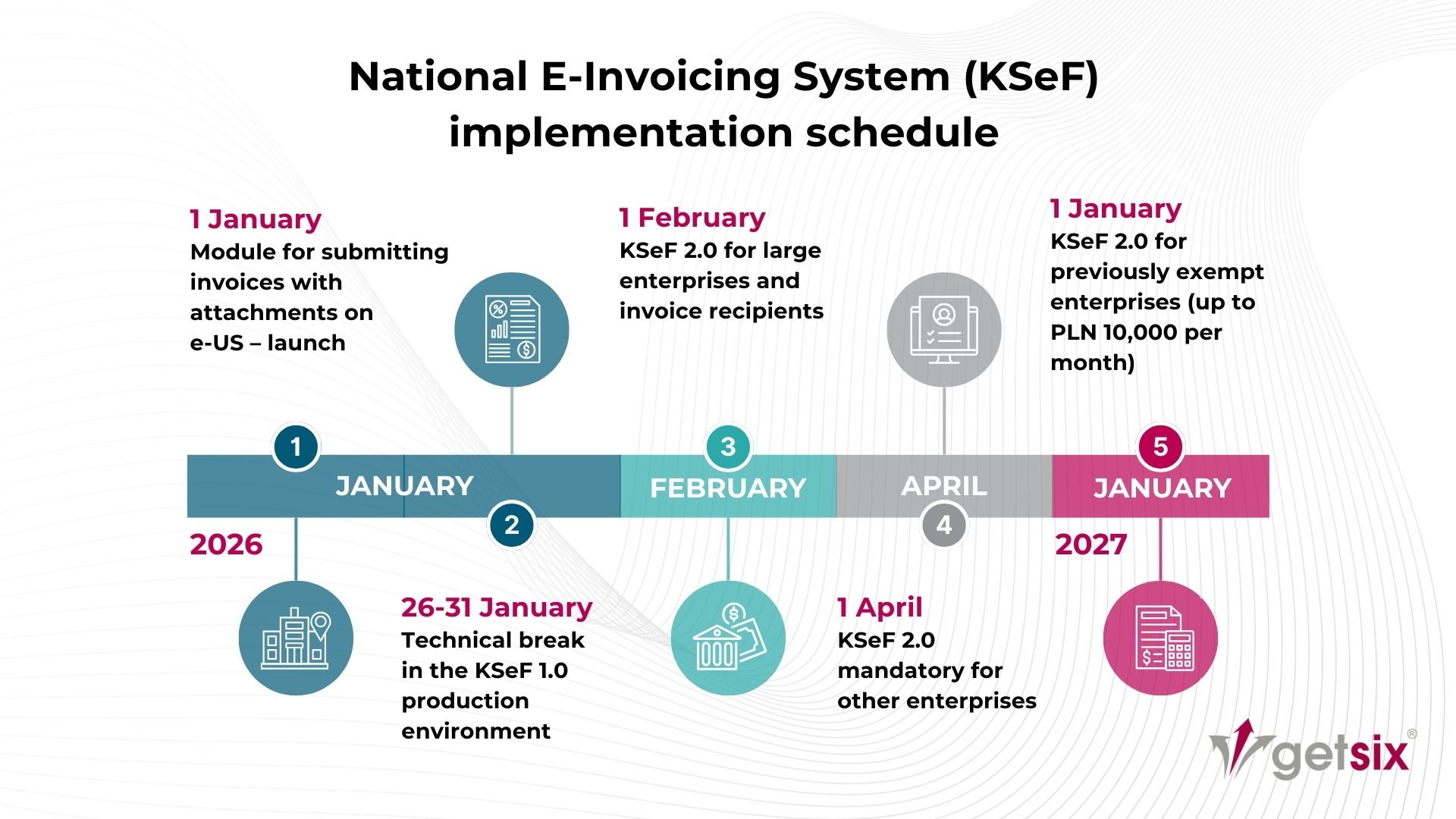

Below is a more detailed and structured summary of the entire National E-Invoicing System schedule: both what has already happened and what lies ahead.

In this article:

What has already happened in the National E-Invoicing System (KSeF) in Poland – a complete overview

Closure of the National E-Invoicing System (KSeF) 1.0 stage – September 2025

On 1 September 2025, the Ministry of Finance shut down the KSeF 1.0 test environment. This marked the end of the stage based on the first version of the test infrastructure system, which had been used by businesses and software providers over the previous years to prepare and verify integration with the system.

The decommissioning of the test environment means that from now on, all new development and testing work can only be carried out within KSeF 2.0. The production version of KSeF 1.0 will remain available only until the planned technical break, which will take place at the turn of January and February 2026. This is part of the transition to the target version of the system, which will be KSeF 2.0.

Start of open testing of the National E-Invoicing System (KSeF) 2.0 API – end of September 2025

On 30 September 2025, the Ministry of Finance launched open testing of the KSeF 2.0 API. From that moment on, providers of financial and accounting systems and ERP systems can check the operation of the new version of the communication interface, including the method of data exchange, validation schemes and the handling of return messages.

Making the API available in open testing mode has allowed software manufacturers to begin technical preparations for integration with KSeF 2.0. This allows companies using commercial accounting systems to gradually obtain information about the availability and compatibility of their tools with the new version of the system.

Release of the pre-production API environment – October 2025

On 15 October 2025, the Polish Ministry of Finance made the pre-production (Demo) environment of the the KSeF 2.0 API available. This is a stage that allows testing in conditions similar to production – in terms of function availability, communication methods and system logic.

This allows software providers to verify the integration of their systems with the KSeF 2.0 in a more advanced manner, prepare final implementation solutions, update technical documentation and conduct business process tests. The release of the pre-production environment confirmed that the work is proceeding according to the schedule announced by the Polish Ministry of Finance.

Certificates and Authorisations Module (MCU) – November 2025

On 1 November 2025, the Polish Ministry of Finance launched the Certificates and Authorisations Module (MCU). This module is responsible for managing access to the National E-Invoicing System (KSeF), including granting, revoking and verifying user authorisations.

The module enables companies to build a role structure and define access scopes in the National E-Invoicing System (KSeF) system — from users issuing invoices to administrators responsible for authorisation and configuration. The MCU is a key component ensuring the security, control and proper functioning of KSeF 2.0 in the mandatory model.

New National E-Invoicing System (KSeF) 2.0 Taxpayer Application — testing and pre-production version

On 3 November 2025, the KSeF 2.0 Taxpayer Application was made available in a test environment, and on 15 November 2025, the application was launched in a pre-production environment (Demo).

The trial version allows you to explore the system’s functionality in general, while the pre-production environment allows you to log in using real owner data and check the handling of processes in a configuration that reflects practical use. This allows companies to test invoicing, attachment handling, permission management and working with the new interface.

Making the application available in both environments allows companies and accounting offices to prepare internal procedures and conduct user training before the system becomes mandatory.

getsix® supports companies in the process of adapting to National E-Invoicing System (KSeF). As a Microsoft partner, we implement Microsoft Dynamics 365 Business Central, which is fully integrated with KSeF and streamlines financial and accounting processes. We also offer the Customer Invoice and Workflow Portal with a mobile application – a modern tool for the circulation, approval and verification of invoices. We encourage you to contact the getsix® team to select the optimal solution for your company and prepare it for the upcoming changes.

What’s coming – full schedule of changes in 2026

1 January 2026 – new module for submissions and attachments in Polish e-Tax Office (e-US)

From the first day of 2026, a module for invoice submissions with the option of adding attachments will be available in the Polish e-Tax Office (e-US). This function will be available to taxpayers who have previously declared their intention to use invoices with attachments. Attachments sent in this way will be treated as part of the documentation related to the invoice and will be linked to its number in the National E-Invoicing System (KSeF) system.

Although the attachment will become part of the invoice, its scope will be limited — not all types of documents will be able to be attached using this mechanism. Despite these limitations, the solution will significantly improve the flow of information, reduce the need for correspondence outside the system, and facilitate the completion of accounting documentation.

26–31 January 2026 – technical break

This is a moment of great technical significance.

During this period, KSeF 1.0 will be officially phased out and replaced by the target KSeF 2.0 infrastructure. The system will be unavailable, which means that companies will have to implement contingency procedures. Entrepreneurs must determine in advance how they will issue documents while the system is unavailable and how quickly they will complete them once full functionality is restored.

This is also the last moment for final testing by software providers and completion of integration.

1 February 2026 – launch of the target version of the National E-Invoicing System (KSeF) 2.0

On 1 February 2026, the Polish Ministry of Finance will launch the final version of KSeF 2.0. This will be the moment when the entire system switches to the new architecture, and for large enterprises, the start of actual operations under the new invoicing model.

1 February 2026 – change in the logical structure of the invoice to FA(3)

From 1 February 2026, with the launch of the target version of the National E-Invoicing System (KSeF) 2.0, a new logical structure of structured invoices marked with the symbol FA(3) will come into force. It will replace the existing FA(2) structure. The FA(3) version has been expanded to include additional fields, such as a wider range of identification data, the ability to provide information about attachments, and new elements related to document handling processes.

1 April 2026 – obligation to use the National E-Invoicing System (KSeF) for most VAT taxpayers

On 1 April 2026, KSeF will become mandatory for most VAT taxpayers. From that date, all sales and purchase invoices will have to be issued and received exclusively through the KSeF 2.0 system. This deadline applies to businesses that were not covered by the earlier obligation from 1 February 2026 and marks a complete transition to a uniform, electronic invoicing model.

1 January 2027 – mandatory National E-Invoicing System (KSeF) 2.0 for previously exempted micro-entrepreneurs

From 1 January 2027, the obligation to use KSeF 2.0 will also apply to the smallest entrepreneurs who have been temporarily exempted from the obligation due to the low scale of their activity, i.e. those with sales not exceeding PLN 10,000 per month. This date has been set as an additional implementation stage to allow micro-enterprises to smoothly adapt their processes and software to work in the e-Invoice system.

getsix® offers comprehensive e-invoicing solutions tailored to the size of the company and the specifics of the industry. We help prepare organisations to work in KSeF 2.0 in an orderly manner and without operational downtime — please contact us for details.

At the end of November 2025, it is clear that the National E-Invoicing System (KSeF) project has moved from the planning stage to the final stage of market preparation. All key modules, environments and tools have been made available – both for integrators and entrepreneurs. The coming months will therefore be a period of intensive implementation, testing and training.

Entrepreneurs should treat these changes as a real transformation of the way they work, rather than just another obligation. With advance preparation, chaos can be avoided at key moments — primarily at the turn of January and February and during the period of mandatory work in KSeF 2.0.

We also encourage you to read the practical guide for entrepreneurs, which provides step-by-step assistance in planning the implementation of KSeF and avoiding mistakes: How to efficiently prepare for KSeF? A comprehensive guide for entrepreneurs.

If you have any questions regarding this topic or if you are in need for any additional information – please do not hesitate to contact us:

CUSTOMER RELATIONSHIPS DEPARTMENT

ELŻBIETA

NARON-GROCHALSKA

Head of Customer Relationships

Department / Senior Manager

getsix® Group

***