Returning to Poland: tax relief for returnees – a complete guide for those returning from emigration (Part 1)

Returning to Poland after years of emigration is a huge life change for many people. In addition to new family and professional challenges, there are also formal issues to deal with, including those related to taxes. One of the most important tools supporting people who decide to return to Poland from abroad is the so-called return tax relief, i.e. a four-year exemption from PIT for certain types of income. This is a real, measurable incentive worth up to several tens of thousands of zlotys per year, depending on income.

In this guide, we explain who is eligible for the return tax relief, what benefits it offers, how to take advantage of it and how it works in practice — including in situations most commonly encountered by emigrants, such as returning to Poland from emigration in Germany, England or other EU and non-European countries.

In this article:

What is the return tax relief?

According to Article 21 of the PIT Act, the so-called PIT-0 return relief consists of a tax exemption on income up to PLN 85,528 per year for four consecutive tax years, counting from the year of return or — if more profitable — from the following year.

The exemption applies to, among other things, income from full-time employment, contract work, business activity (scale, linear, lump sum, IP Box) and maternity benefits.

This means that a person returning to the country and earning, for example, PLN 85,000 per year can pay PLN 0 in PIT for four years, and with higher earnings, significantly reduce their tax.

For many people, this is one of the biggest incentives to transfer their tax residence to Poland after years of working abroad.

getsix® supports clients in both tax advisory and comprehensive HR and payroll services, thanks to which the entire process of returning to Poland — from analysing the conditions of the relief, through preparing documentation, to ongoing settlements — can proceed smoothly, correctly and without the risk of unnecessary costs.

Who can benefit from the return relief?

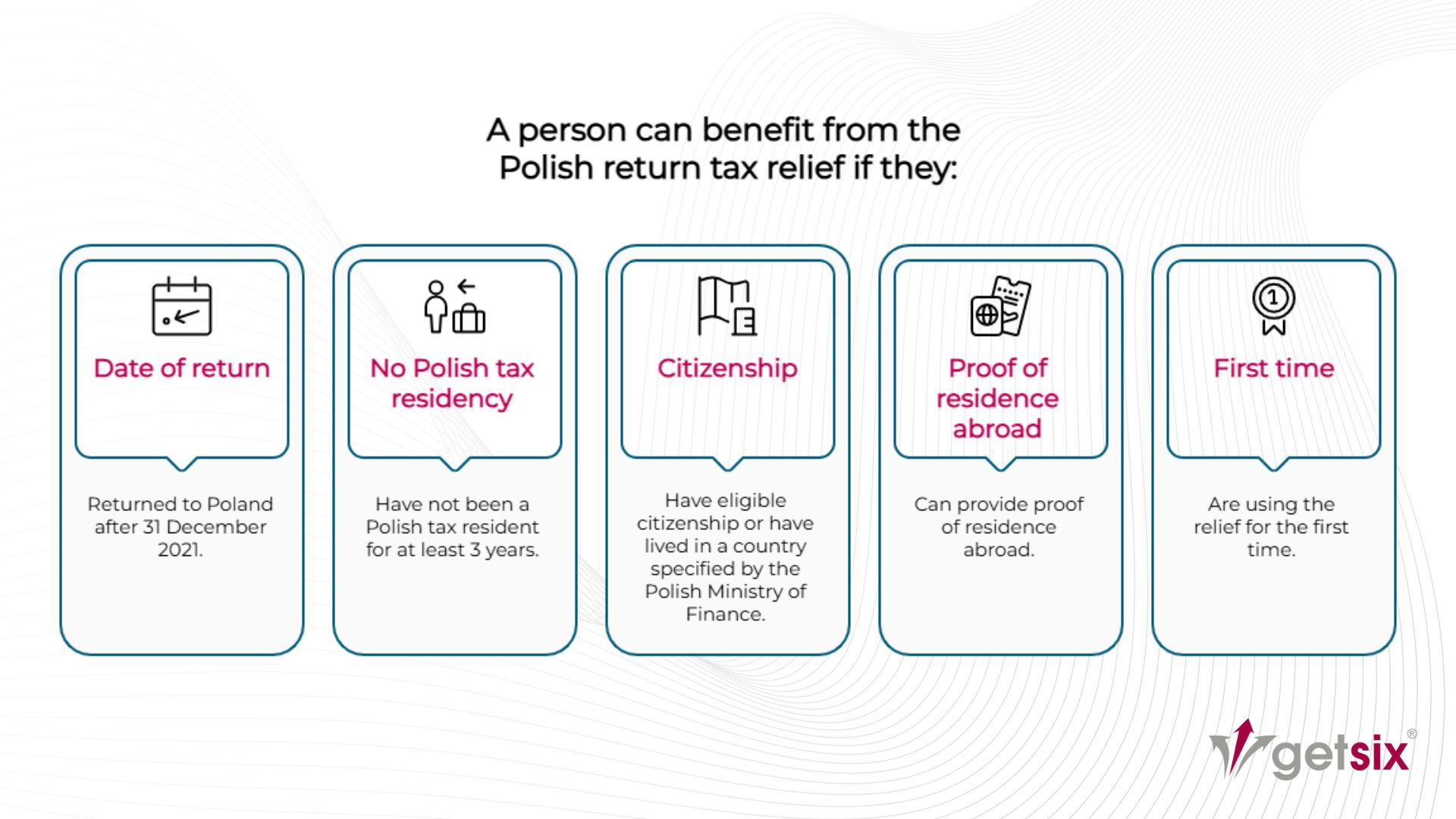

The conditions for the relief are quite detailed, but at the same time accessible to most people planning to return to Poland from abroad. In order to benefit from the relief, you must meet all of the following key criteria collectively:

1. Return to Poland after 31 December 2021.

The relief only applies to those who moved their place of residence to Poland after 31 December 2021. Therefore, if the return took place in 2022, 2023, 2024, 2025 or later, this condition can be met.

2. No tax residence in Poland for at least 3 years

In order to benefit from the relief, you must prove that you did not have a place of residence in Poland for three full calendar years prior to the year of return, as well as from the beginning of the year of return until the day preceding your arrival.

In practice, many people planning to return to Poland meet this condition without any complications.

3. Citizenship or specific country of residence The return tax relief is available to persons who have:

- Polish citizenship, or

- a Polish Card, or

- citizenship of an EU/EEA/Swiss country,

or — alternatively — have lived for at least 3 years in one of the countries listed in the Act, including Germany, the United Kingdom, the USA, Canada, Australia, South Korea and many others.

4. Documents confirming residence abroad

You do not need to have a certificate of residence (although if you do, that’s great). It is sufficient that the documents clearly show that you have lived abroad for the required period of time. These may include, for example, rental agreements, employment contracts, foreign PIT forms, registration confirmations, tax returns, contracts, and statements.

5. First use of the relief

The return relief is a one-off benefit. If you have already used it, you cannot use it again on your next return.

What income is covered by the return relief?

The relief applies to income most commonly earned by people returning from emigration, including:

- income from full-time employment (employment contract, service relationship),

- income from contract of mandate,

- income from business activity (scale, flat rate, IP Box 5%, lump sum),

- maternity allowance.

However, the relief does not cover, for example, income from specific task contracts, copyrights (except those under an employment contract), sickness benefits, certain capital gains or income that is already exempt on other grounds.

It is also worth remembering that the limit of PLN 85,528 is common to all PIT-0 reliefs, i.e. also the 4+ relief, the relief for young people and the relief for working seniors. If a taxpayer uses several reliefs, the sum of all exempt income cannot exceed this amount.

When and for how long can the return allowance be applied?

One of the biggest advantages of the return allowance is the ability to choose when it starts to apply. The taxpayer decides whether to start applying it:

- from the year in which they returned to Poland, or

- from the following year.

This is very important when returning at the end of the year — in such a situation, it is usually more advantageous to start from January of the following year and have a full four years of relief, instead of losing one year for a few months of work in Poland.

The relief is valid for 4 consecutive years — without interruptions or suspensions.

How to use the relief in practice?

After returning to Poland from emigration, the way you take advantage of the relief depends on the type of income you earn.

In the case of full-time employment or a contract of mandate, it is sufficient to submit a written statement to the employer confirming that the conditions for the relief are met. The employer will start applying the exemption from the following month at the latest. The final settlement is still made in the annual PIT return.

In the case of business activity, the taxpayer applies the relief themselves — excluding the income covered by the exemption from the tax base and keeping an eye on the limits and the 4-year period.

Why is it worth preparing well for your return to Poland?

Changing your tax residence and correctly applying for the return relief requires not only meeting the formal conditions, but also preparing the relevant documents and choosing the optimal moment to start the relief. Many people lose some of the benefits simply because they submitted their declaration incorrectly or started the relief in an unfavourable tax year. This is an area where the support of professionals — especially companies providing HR, payroll and tax settlement services — can save both time and real money.

Returning to Poland from emigration is not only a return home — it also involves formal and financial decisions that are worth planning well. The return tax relief is one of the most attractive tax preferences in the Polish system and can really make the first years after returning easier.

If you need to verify that you meet the conditions for the relief, prepare the required statements, obtain support in registering your residence, or receive comprehensive HR and payroll services after returning to Poland, it is worth seeking the help of specialists. In the next parts of the ‘Returning to Poland’ series, we will discuss the next stages related to moving, formalities and settlements, and our team can support you throughout the entire process — from tax issues to ongoing employee services. Contact us.

If you have any questions regarding this topic or if you are in need for any additional information – please do not hesitate to contact us:

CUSTOMER RELATIONSHIPS DEPARTMENT

ELŻBIETA

NARON-GROCHALSKA

Head of Customer Relationships

Department / Senior Manager

getsix® Group

***