Revenue and expense ledger in Poland – obligations, benefits and common mistakes

The revenue and expense ledger (Polish: KPiR) is the primary accounting record-keeping tool for sole proprietorships and partnerships. It allows income and business expenses to be recorded in a manner that enables accurate calculation of income tax. In practice, it serves as the daily operational hub of a company’s finances. A properly maintained ledger is not only a statutory requirement but also a valuable source of business insights into profitability and operational costs.

In this article:

What is the revenue and expense ledger (KPiR) and what is its purpose?

The revenue and expense ledger (KPiR) is a simplified form of accounting record that enables the registration of all income and costs associated with business activity. Its main objective is to correctly determine taxable income and to prepare data for the annual tax return.

However, a well-maintained KPiR serves a much broader function – it facilitates ongoing analysis of a company’s financial position. It helps identify the most profitable activities, monitor costs, and plan finances. This practical tool supports business decision-making based on reliable accounting data – particularly important for micro and small businesses that do not use full accounting.

Under the regulations, the KPiR is not merely a legal obligation – it is a tool that genuinely supports business operations and profitability management.

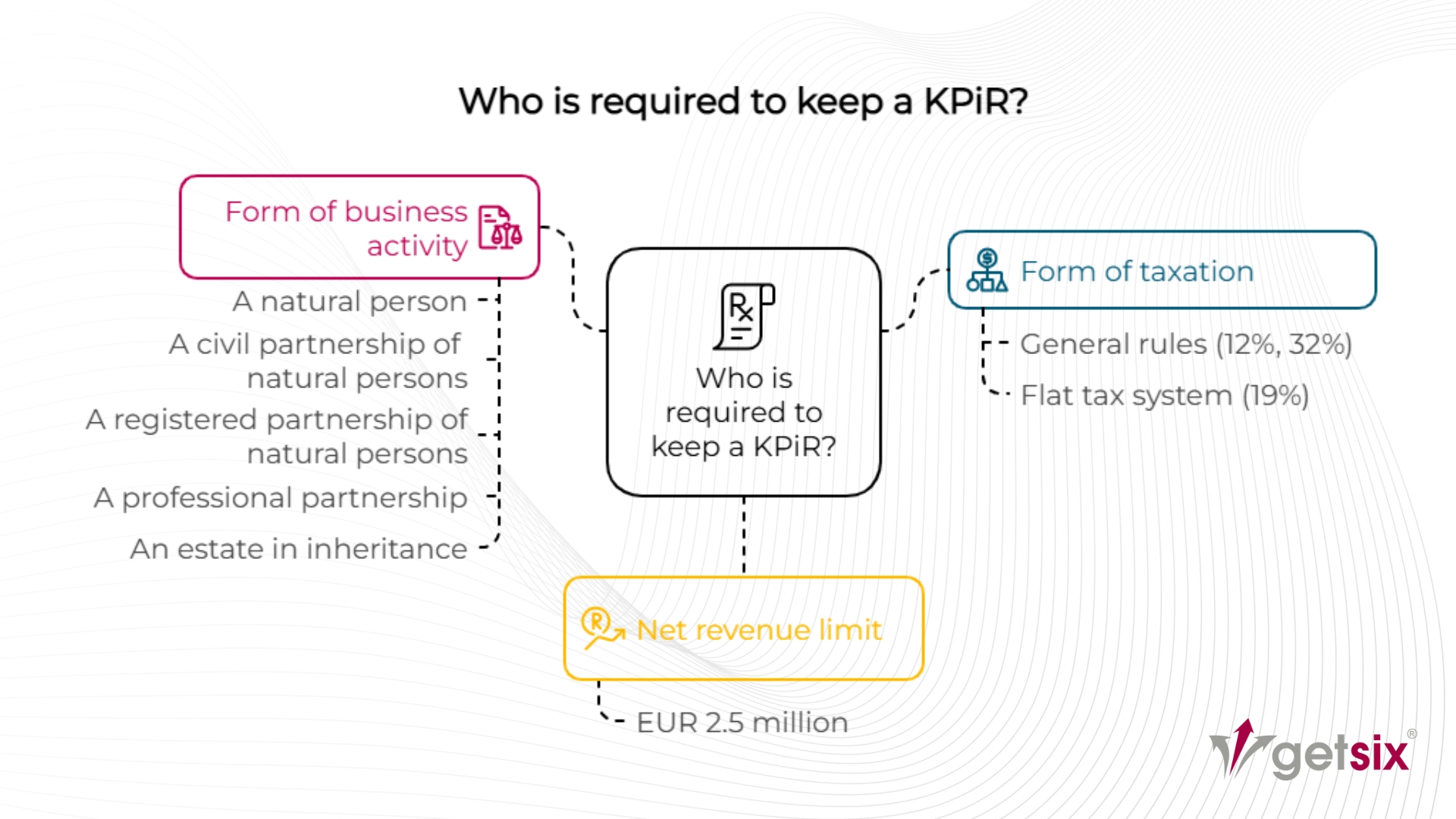

Who is required to keep a KPiR?

The revenue and expense ledger (KPiR) may be kept only by taxpayers who meet the following three criteria:

Form of taxation

They settle income tax:

- under general rules (tax scale – 12% and 32%), or

- under the flat tax system (19%).

Form of business activity

They operate as:

- a natural person,

- a civil partnership of natural persons,

- a registered partnership of natural persons,

- a professional partnership,

- or an estate in inheritance.

Revenue limit

Net revenues (excluding VAT) from business activity in the previous year did not exceed EUR 2.5 million (approximately PLN 10.7 million based on the 2024 threshold).

If this threshold is exceeded, the taxpayer is required to switch to full accounting under the Accounting Act.

Example:

If a company’s revenue in 2024 exceeds PLN 10,711,500 net, the entrepreneur must maintain full accounting from 2025.

Voluntary full accounting – a conscious choice

Instead of keeping a revenue and expense ledger, entrepreneurs may opt for full accounting in accordance with the Accounting Act. This form of record-keeping provides greater financial transparency and is often preferred when dealing with banks, investors, or foreign business partners.

If you are planning to start an activity subject to the obligation of maintaining full accounts or are considering changing your accounting method, please feel free to contact us. The getsix® team offers comprehensive support for the implementation and management of full accounting – from needs analysis to ongoing services and advisory. Contact us using the form.

When and how should a KPiR be established?

The KPiR is established:

- on 1 January of the given tax year, or

- on the date the business activity commences if started mid-year.

The revenue and expense ledger may be kept:

- in paper form – using a bound ledger with handwritten, chronological entries,

- electronically – using software capable of generating records compliant with the Regulation of the Minister of Finance.

The choice of format is up to the entrepreneur, although electronic form will become mandatory from 2026.

Regardless of format, the ledger must be kept in Polish language and in Polish currency, on an ongoing basis and in a reliable and error-free manner.

Reliability means compliance with the actual course of business transactions, while error-free means technical correctness (e.g. numbering, order of entries, no missing pages). Breaches of these rules may result in the tax authority rejecting the ledger and imposing fiscal penalties.

What must a KPiR contain?

The revenue and expense ledger is not just a table of figures – it is a structured record whose form and content are specified in the Regulation of the Minister of Finance. The accuracy of entries in the KPiR directly affects the correctness of tax settlements.

Required formal data

Each KPiR must contain the title “Podatkowa Księga Przychodów i Rozchodów”, the month and year, and the entity’s identification details, as per the template defined by the Minister of Finance.

Accounting evidence – the basis for entries

Entries must be supported by accounting evidence such as:

- VAT invoices, VAT RR invoices, receipts, customs documents,

- fiscal reports, daily invoice summaries,

- corrective accounting notes,

- internal, bank, postal, or transfer documents,

- descriptions of goods or materials (if the invoice was delivered later).

Each document must include:

- the parties’ details (name, address),

- document and transaction dates,

- a description and value of the transaction,

- the issuer’s signature,

- a reference number linking it to the ledger entry.

The tax revenue and expense ledger table consists of 17 columns used to record all business transactions. They include, among other things, the entry number and date, accounting document designation, contractor details, description of the event, and a detailed breakdown of revenues and costs. The ledger records both sales and purchases of materials, salaries, other expenses and research and development costs. The structure of the revenue and expense ledger is specified in the appendix to the Regulation of the Minister of Finance and applies to all entrepreneurs regardless of the form of the ledger (paper or electronic).

Additional registers maintained with the KPiR

Keeping a revenue and expense ledger also involves the obligation to keep several supplementary records, depending on the type of business activity and the assets used. Entrepreneurs are required to keep a register of fixed assets and intangible assets. If accounting is outsourced to an accounting office and sales are not made through a cash register, sales records are also required. Additionally, if a vehicle is used exclusively for business purposes and the entrepreneur wishes to fully settle its operating costs, it is necessary to keep vehicle mileage records. On the other hand, entrepreneurs running a currency exchange business must record the purchase and sale of currencies.

It is worth noting that some of the obligations have been abolished. It is no longer necessary to keep personal income cards for employees or records of equipment, even in the case of assets worth more than PLN 1,500, if their period of use does not exceed one year.

Common mistakes and consequences of incorrect KPiR management

Even with good organisation and the best intentions, it is easy to make mistakes when keeping a revenue and expense ledger, and the consequences can be costly. The most common irregularities include: lack of chronology of entries, untimely recognition of transactions, accounting errors, incomplete accounting documentation and incorrect classification of costs. In practice, this means, for example, entering an invoice after the deadline, underestimating the value of turnover or recognising an expense that does not constitute a tax-deductible cost.

Such irregularities may result in the tax office questioning the ledger. If the revenue and expense ledger is found to be defective, the tax base may be adjusted. However, if the book is deemed unreliable, the tax authorities may independently estimate the income and impose sanctions, including a fine for a fiscal offence or crime. Therefore, consistency, compliance with regulations and proper documentation of each operation are the basis for safe accounting of business activities.

Switching between accounting methods – KPiR, lump-sum tax, and full accounting

Changing the form of accounting records is a common step in business development – whether due to scaling up operations or simplifying tax settlements. However, the choice is not always optional, so it is important to understand the rules for transitioning between the revenue and expense ledger (KPiR), lump-sum taxation, and full accounting.

How to switch from KPiR to lump-sum tax on recorded revenue?

Switching from the revenue and expense ledger (KPiR) to lump-sum taxation also means changing the method of record-keeping. Instead of maintaining the KPiR, the entrepreneur keeps a simplified register of revenue, without the ability to deduct business expenses.

Lump-sum taxation is available to entrepreneurs whose net revenues in the previous year did not exceed EUR 2 million and who do not conduct activities excluded from this taxation scheme – such as legal, consulting or financial services.

The form of taxation cannot be changed mid-year – the decision to opt for lump-sum taxation must be submitted by the 20th day of the month following the month in which the first revenue was earned in the given tax year (or by the end of January if the business continues). In the case of partnerships, each partner must submit a separate declaration to their relevant tax office based on their place of residence.

How to return from full accounting to KPiR?

Returning to simplified accounting is possible if, in the next tax year, the entrepreneur does not exceed the statutory revenue threshold and continues to meet the requirements regarding legal form and taxation method.

The change may take effect at the beginning of the new tax year. The entrepreneur is not required to notify the tax office of ceasing full accounting or starting to keep a KPiR – it is sufficient to meet the statutory conditions and begin keeping simplified records in accordance with the regulation.

For tax security and a smooth transition between accounting methods, consultation with an accountant or tax adviser is recommended – especially when it involves restructuring the chart of accounts, opening a new register, and ensuring that documentation from previous years is stored in compliance with the Accounting Act. Contact us using the form.

The revenue and expense ledger (KPiR) is a simplified accounting record, applicable to sole proprietorships and partnerships that have not exceeded the revenue limit of EUR 2.5 million. The KPiR allows you to record revenues and costs, and its purpose is to correctly determine taxable income. It can be kept in paper or electronic form (mandatory from 2026). It requires reliability, compliance with documentation and systematic data entry. Correct bookkeeping is crucial for tax security and financial analysis of the company.

If you have any questions regarding this topic or if you are in need for any additional information – please do not hesitate to contact us:

CUSTOMER RELATIONSHIPS DEPARTMENT

ELŻBIETA

NARON-GROCHALSKA

Head of Customer Relationships

Department / Senior Manager

getsix® Group

***