Obligation to complete the data in the Central Register of Real Beneficiaries

Dear Sir/Madam,

On 13 October 2019, the Central Register of Beneficial Owners began to operate. It is an IT system maintained by the minister competent for public finance, used to process information about beneficial owners beneficiaries, i.e. natural persons exercising control over Polish commercial companies.

Below we present the basic problems that are connected with the obligation to giving a notification to the Register:

1. WHO IS OBLIGED TO GIVE A NOTIFICATION OF THE BENEFICIAL OWNER?

Notifications to the Register are made by the following commercial companies:

- general partnerships (spółki jawne),

- limited partnerships (spółki komandytowe),

- limited joint-stock partnerships (spółki komandytowo-akcyjne),

- limited liability companies (spółki z ograniczoną odpowiedzialnością),

- simple joint-stock companies (proste spółki akcyjne) (from the 1 January 2021),

- joint-stock companies (spółki akcyjne), with the exception of companies whose securities are admitted to trading on a regulated market subject to disclosure requirements according to European Union law or the corresponding law of a third country.

2. WHO IS A BENEFICIAL OWNER?

The Beneficial Owner is a natural person or natural persons exercising directly or indirectly control over a commercial company through their rights, which result from legal or factual circumstances, enabling the decisive influence over the activities undertaken by that company, or a natural person or natural persons in on behalf of whom business relations are established or an occasional transaction is carried out, including in the case of a company which is a legal person:

- a natural person who is a shareholder in a commercial company with a property right of more than 25% of the total number of shares in that legal person,

- a natural person holding more than 25% of the total number of votes in the decision making body of commercial company, also as a pledgee or user, or on the basis of agreements with other persons entitled to vote,

- a natural person exercising control over a legal person or legal persons, who jointly have a property right of more than 25% of the total number of shares in a commercial company, or jointly holding more than 25% of the total number of votes in a commercial company, also as a pledgee or user, or on the basis of agreements with other persons entitled to vote,

- a natural person exercising control over a commercial company by having the rights referred to in art. 3 paragraph 1 point 37 of the Act of 29 September 1994 on accounting, especially by having the status of the parent entity in relation to this legal person, or having rights to manage the financial and operational policy of this company, based on an agreement concluded with this company or the company’s statute or company agreement, or

- in the case of documented inability to determine or doubt as to the identity of the natural persons referred to above and in the case of no suspicion of money laundering or terrorist financing – a natural person in a senior management position.

3. WHICH DETAILS ARE SUBJECT TO NOTIFICATION?

- Identification details of companies:

- business name of a company,

- organisational form,

- registered office,

- number in National Court Register,

- Tax Identification Number.

- Identification details of the beneficial owner and a member of the body of the company or a shareholder entitled to represent the company:

- name and surname,

- citizenship,

- country of residence,

- a PESEL number or date of birth – for persons who do not have a PESEL number,

- information on the size and nature of the participation or rights, which the beneficial owner is entitled to.

The Register is public and access to it is free. The Register is kept by the Ministry of Finance in the ICT system.

Updated: 10-07-2020

Due to the statement concerning the epidemic, and then the Polish government bringing into force the anti-crisis 1.0, the deadline was postponed for the submission of information concerning the ‘Central Register of Real Beneficiaries’.

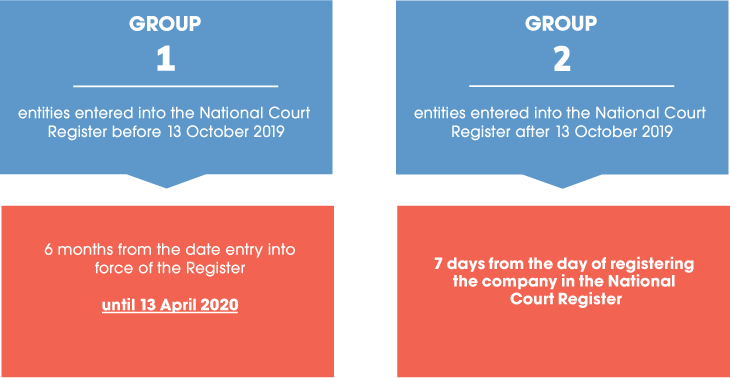

The deadline for reporting the actual beneficiary information to the ‘Central Register of Real Beneficiaries’, for companies registered in the Polish KRS system before 13th October 2019, was postponed until 13th July 2020.

Entities registered in the Register are required to report to the Register a change in their identification details concerning them or a change in the identification details of the beneficial owner within 7 days from the date of their change.

For entities entered into the National Court Register before 13 October 2019, the deadline was extended to 13 April 2020. However, bearing in mind that in some situations determining the beneficial owner may be time-consuming, measures should be taken in advance to obtain relevant information in this regard.

5. HOW TO REPORT A BENEFICIAL OWNER TO THE REGISTER?

Notifications to the Register are made free of charge, in the form of an electronic document in according to the template provided by the Ministry of Finance, provided with a qualified electronic signature or signature confirmed by an ePUAP trusted profile, available at the link https://crbr.podatki.gov.pl/adcrbr/#/.

ATTENTION! Only the person entitled to represent the company will be able to give the notification to the Register. It is not possible to entrust this task to other persons, including professional proxies.

Notification to the Register will contain an obligatory statement of the person giving the notification of the truth of the information reported. This statement is made under pain of criminal liability for submitting a false statement.

6. WHAT IF WE DO NOT GIVE THE NOTIFICATION TO THE REGISTER WITHIN THE REQUIRED TIME?

Companies that have not complied with the obligation to give a notification with the required information to the Register within the time limit specified in the Act, shall be subject to a financial penalty of up to PLN 1,000,000.

If you have any questions, please contact our customer desk, or use the contact form on our website.

***

We are an independent member of HLB. THE GLOBAL ADVISORY AND ACCOUNTING NETWORK.