Business news from Poland

![]()

When developing the Polish FinTech sector foreign expansion is necessary

Poland is the largest FinTech centre in Central East Europe (CEE). According to Deloitte Poland, the value to the Polish economy is around EUR 860million within this sector. The latest report from Deloitte shows that 72% of start-ups in Poland are funded using founders’ capital. Meanwhile, the share of venture capital for investment in finance and technology companies accounts for approx. 70%, globally.

Artur Martyniuk of Deloitte said “The Polish financial sector is very innovative compared to many other branches of Polish economy. Some of the biggest Polish banks in fact can be called FinTech’s, as their high-tech solutions are already licensed abroad”.

According to Deloitte experts, foreign growth is a pre-requisite for acquiring new customers for Polish FinTech companies. Conversely, Polish financial organisations have been restricted to International markets, this slows down the progression of scaling on the Polish and International markets. The experts also claim that FinTech and financial organisations are an impeccable match: FinTech companies deliver technology, while organisations can provide customers. Additionally, a large percentage of financial companies are controlled by foreign investors, so strategic choices are made abroad.

Polish industry has significant growth

The PMI index within the Polish industrial sector has increased from 52.7 in May to 53.1 in June, according to HIS Markit. This highlights the progress of the economic condition in the Polish industry that is generally determined by a growing capacity of production and the increasing number of new orders for the industry.

The PMI index has been on the rise for eight months, so it is a good time for the Polish industry, HIS Markit experts maintain.

While entering Summer the Polish industrial sector has increases in orders, including those from abroad. The growth of employment is affected in this sector of the Polish economy. This is in contrast to the preceding month, in June, with the total number of new orders improved faster than the number of export orders.

The Association of Business Service Leaders (ABSL): Quarter of a million people employed within the Business Service Sector (BSS) in Poland

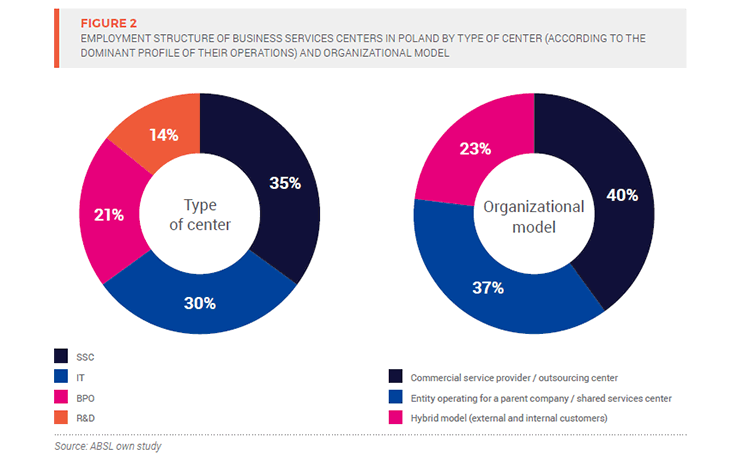

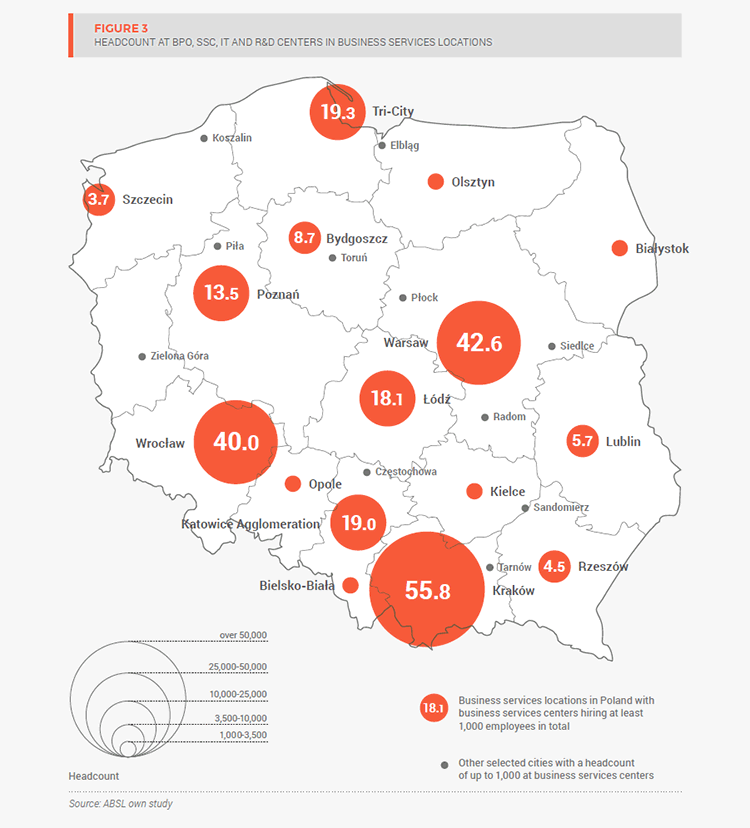

BSS is the fastest developing area of the Polish economy. The recent ‘Business Service Sector in Poland’ report by ABSL shows that the scale of employment and consistent growth in the number of jobs and the broadening of the scope of business of companies with BPO, SSC, IT and R&D centres in Poland, help strengthen the countries position among major business services destinations world-wide.

According to ABSL experts, having a presence in Poland offers a competitive advantage and boosts companies’ growth potential.

In the past 12 months (Q1 2016 – Q1 2017), the number of jobs in the BSS in Poland increased by 32,000 (15%), ¾ of which were created by foreign centres. Thus, 748 business services centres by 52 foreign companies now employ as many as 198,000 people in Poland. In Q1 2017, Poland was home to a total of 1,078 business services centres with Polish and foreign origins. They jointly have employed 244,000 people. Out of the 724 companies with business services centres in Poland, 80 are investors featured on the ‘Fortune Global 500 (2016)’ list, with 67,000 employees at 134 business services centres (27% of the jobs in the industry). Given the industry’s growth in recent years, it may be assumed that by 2020, business services centres will be employing more than 300,000 people.

(Source: Polish Investment and Trade Agency – www.paih.gov.pl)