Best company for a family business

![]()

Many undertakings conducting activity in our country, are family undertakings. Such a business may also be conducted in a company. The law does not provide for any special limitations or requirements for companies comprised of family members. They may choose between a civil-law partnership and commercial companies (partnerships/companies). Partnerships include: registered partnerships, professional partnerships, limited partnerships and limited joint-stock partnerships. Companies include limited liability companies and joint-stock companies. Companies have some common characteristics but, most importantly, certain peculiarities. When choosing the legal form for a business run together, one should learn the legal construction of a given company, rules on liability for debts or matters connected with paying ZUS (Social Security Authority) premiums. While for some this may constitute an additional financial burden, then in other cases being subject to social security and paying premiums.

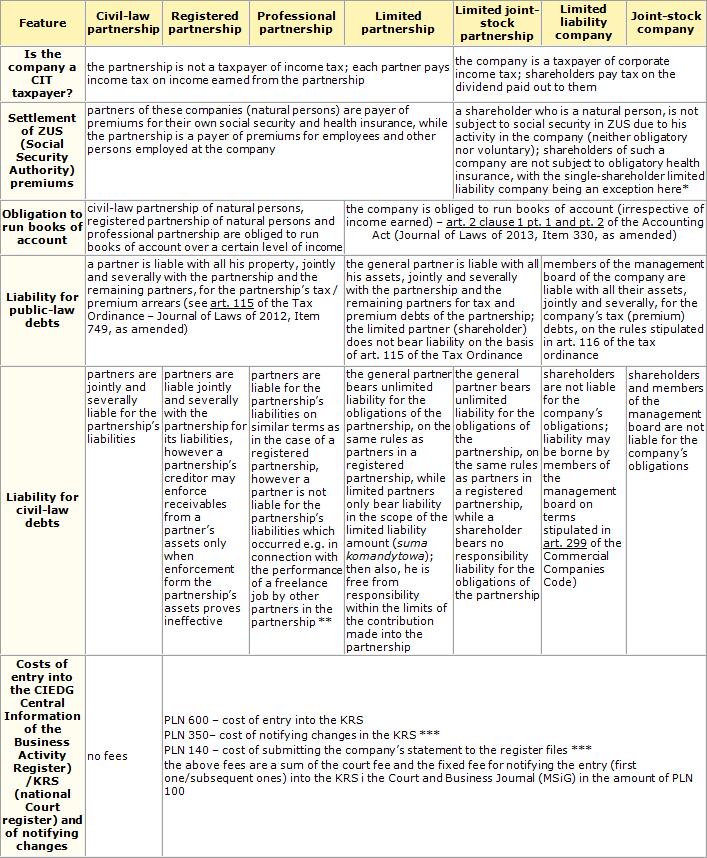

A summary of main characteristics of companies

* towards the shareholder in a single-shareholder limited liability company, the general terms of being subject to insurance in ZUS and paying premiums, shall apply

** the articles of association may stipulate that one or more partners accept to bear liability like a partner in a registered partnership (Art. 95 of the CCC)

*** these fees are applicable after 30 May, 2014 (following the decrease of the fee for announcing subsequent entries from 250 PLN to 100 PLN)

Source: Gazeta Podatkowa of 14 July, 2014